Overspending is a common and often overlooked cause of financial trouble, says Credit Counselling Singapore’s Tan Huey Min.

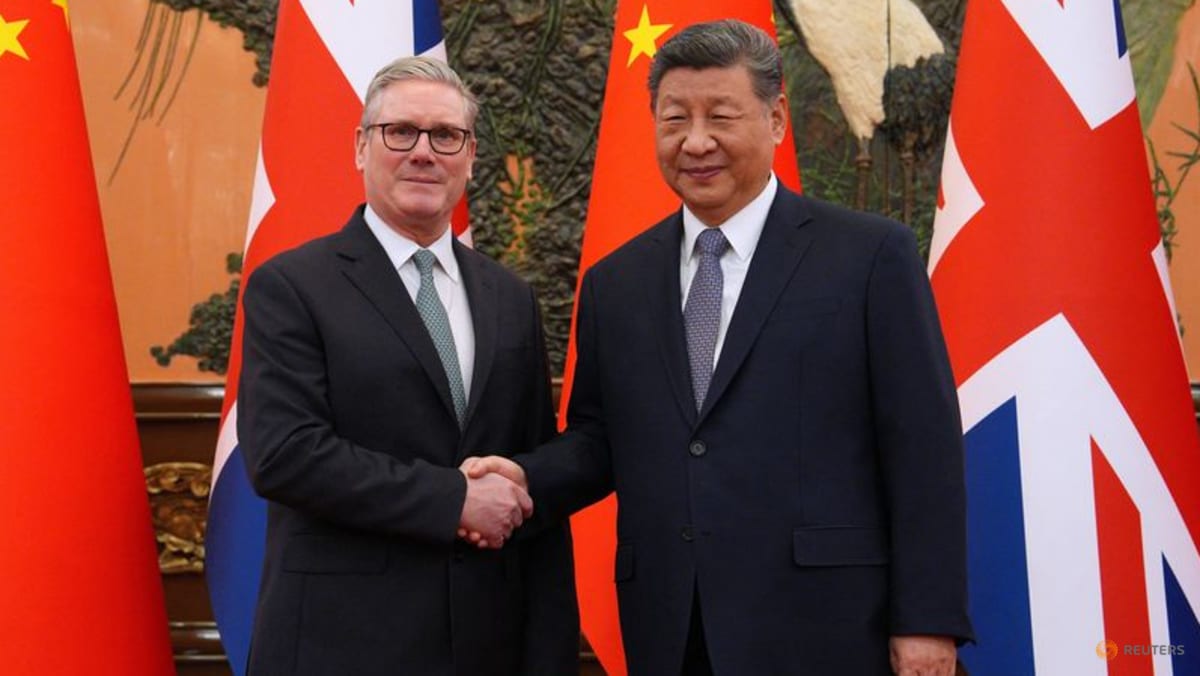

Credit cards are convenient but consumers should remember to use them responsibly, says the Credit Counselling Singapore. (Photo: iStock)

Credit cards are convenient but consumers should remember to use them responsibly, says the Credit Counselling Singapore. (Photo: iStock)

New: You can now listen to articles.

This audio is generated by an AI tool.

SINGAPORE: It seems like more Singaporeans are deferring their credit card bill repayments, going by official figures that show rollover balances hitting a 10-year high last year.

These credit card balances – the outstanding amount not paid by the due date and is subject to interest charges – crossed S$9 billion (US$7 billion) in the third quarter of 2025. Such rollover debt has been rising steadily since the second quarter of 2021.

At the Credit Counselling Singapore (CCS), we have seen an increase in the number of cash-strapped individuals with unsecured debt woes coming forward to seek help.

Last year, the CCS counselled 2,588 distressed debtors with unsecured debts incurred from credit card spending and personal loans – a 26 per cent increase from 2024.

The average debt size was about S$100,000, with home renovations emerging as a new and growing contributor alongside lifestyle spending, job disruptions, family responsibilities and medical expenses.

Certainly, consumer prices have risen over the years and that can, understandably, add to overall expenses. Yet many of these expenditures can be managed with tough but necessary choices, such as scaling back renovations, delaying purchases or opting for alternatives. This suggests that spending beyond one’s means may be the real issue here.

The move towards cashless payments does not help. This means some of us are charging more to our credit cards and for those who are careless with payment due dates, this can lead to higher rollover balances.

The convenience of buying 24/7, thanks to the ease of online shopping, is another possible contributing factor. CCS once counselled a woman who spiralled into debt after buying 30 branded bags with her credit cards. What seemed like an indulgence eventually led to distress.

In short, higher consumer prices, the rise of cashless payments and ease of shopping round the clock have all helped to push up credit card debt and will likely continue to do so.

CREDIT CARDS ARE NEITHER INCOME NOR SAVINGS

To be sure, not all credit card rollover balances warrant alarm. If the banks’ charge off rate – a metric to measure bad debt written off during the year against the average rollover balance – remains low, the rollover balance is probably more of a concern for cardholders who do not have the means or plans to pay within the next three to six months.

Nevertheless, it is important to reiterate that credit cards are neither income nor savings. With high interest charges, these shiny pieces of plastic should be used as a payment mode, not as a source of credit.

When bills come due, unpaid balances trigger interest charges of more than 20 per cent while late fees kick in for overdue payments – all of which can compound quickly and snowball into serious financial trouble.

More worrying are cases where individuals invest with borrowed money, such as credit card advances. Unless investment returns exceed the cost of borrowing – which is something far from guaranteed – this is an approach that is futile and dangerous.

CCS has seen cases of debtors who did so after being lured by promises of high returns, only to lose it all. In one case, properties had to be sold, yet the individual remained saddled with debt of about half a million dollars.

CNA938 Rewind - #TalkBack: Tapping your credit card or phone everywhere, are we mindlessly making payments?

There is another consequence to late or missed payments and high outstanding credit card balances – it can impact one’s credit score adversely.

A credit score isn't just a number - it's a reflection of one’s financial habits with influence over one’s ability to borrow money. A strong credit score opens doors to better financial opportunities, particularly when a person requires financing for significant purchases such as a mortgage or to cover unforeseen expenses like emergency medical bills. On the other hand, a poor credit score can make borrowing more difficult.

KEEP DISCRETIONARY SPENDING IN CHECK

If there is one advice that is worth repeating, it is to spend within one’s limits. Individuals need to distinguish between wants and needs, and take stock of one’s finances.

Start off by creating a budget. Think of this as a financial blueprint to tell your money where to go according to your goals. It is advisable to prioritise savings, monitor spending and adjust when necessary.

For example, when faced with higher prices, this may mean buying less or switching to cheaper alternatives. The goal is not deprivation, but to enjoy without chalking up credit card debt to the extent that it becomes a problem. Even when money feels tight, there are ways to adapt.

For those who enjoy shopping or are generally oblivious of their spending habits, a first step would be to set up automatic transfers to a separate bank account specifically for savings.

Having different spending accounts is also recommended – one for routine expenses such as meals, transport, and utilities, and another for occasional spending like gifts and travel. Doing so can help spending more visible and manageable.

If you still struggle to stay disciplined, limit yourself to no more than two credit cards or request a lower credit limit.

It is also advisable to create spending plans, especially during periods when expenses are likely to rise such as Chinese New Year that is round the corner. If you do overspend and chalk up larger-than-usual credit card bills, rectify it by cutting down on expenses in the following months and prioritise repayments.

Credit cards are convenient but use them in a responsible manner. Be the master of your credit card and don’t let it drag you into a debt pit that steals your financial stability and peace of mind.

Tan Huey Min is general manager at Credit Counselling Singapore, a registered charity helping people address unsecured debt problems.