SHANGHAI: Chinese President Xi Jinping wants the yuan to become a global reserve currency - one that central banks hold in significant quantities, a role which the US dollar has dominated since the Second World War.

The ambition is not new. China launched cross-border yuan trade settlement in 2009 and secured the currency's inclusion in the International Monetary Fund's reserve basket in 2016.

What’s new is Beijing's decision to state it publicly - now.

Qiushi, an official publication of the Communist Party, recently shared excerpts from a hitherto-unpublished 2024 speech by Xi to officials. He called for a “strong currency” - one that is “widely used in international trade, investment and foreign exchange markets” and holds “global reserve currency status”.

He outlined the pillars of what he termed a “financial powerhouse” - a powerful central bank, globally competitive financial institutions, international financial centres, robust regulation and financial talent.

He also acknowledged the scale of the task: China’s financial system is “big but not strong”.

“Building a financial powerhouse requires long-term effort and sustained work,” Xi said.

Adhering to party practice, republishing leaders’ speeches in Qiushi serves as a directive to the bureaucracy and a signal to external audiences.

“It’s less about revisiting an old speech than about signalling urgency,” said Lin Han-Shen, China director at The Asia Group, a leading strategic advisory firm.

“Beijing sees currency power as a national-security issue as the global financial system fragments.”

The yuan accounts for about 1.93 per cent of global foreign exchange reserves, far behind the US dollar's roughly 57 per cent. (File photo: Reuters/Thomas White/Illustration)

The yuan accounts for about 1.93 per cent of global foreign exchange reserves, far behind the US dollar's roughly 57 per cent. (File photo: Reuters/Thomas White/Illustration)

WHY NOW? THE SIGNAL AND ITS TIMING

The environment has shifted dramatically since Xi’s speech in 2024 - back then, the dollar was still in a structural bull cycle.

Since then, the greenback fell roughly 10 per cent in the first half of 2025 - its steepest decline since 1973, analysts noted.

“Liberation Day” tariffs by Trump last year coincided with the dollar’s fall alongside rising market volatility.

Concerns over Federal Reserve independence and a widening US fiscal deficit have also compounded the pressure.

“The lesson that China learned from last year during the trade war is that markets are a remarkable constraint on US behaviour,” said Lin.

China has “really chaffed” under the US dollar dominance, he added.

If the rest of the world traded in yuan, it would “take off the pressure” of sanctions exposure and foreign exchange risk, Lin said, easing some of the “problems Chinese exporters already have in terms of pricing”.

An employee of a bank counts US dollar notes at a branch in Hanoi, Vietnam. (File photo: Reuters/Kham)

An employee of a bank counts US dollar notes at a branch in Hanoi, Vietnam. (File photo: Reuters/Kham)

Lin also pointed to a factor that did not exist at scale in 2024: China's outbound push.

Chinese commerce ministry data showed outward foreign direct investment (FDI) reaching US$192.2 billion in 2024, up 8.4 per cent year-on-year, while overseas mergers and acquisitions surged 70 per cent in the first three quarters of 2025.

These companies face an “asset-liability mismatch”, Lin said - debts in dollars, revenues in yuan.

Transacting in yuan reduces that exposure.

Chief China economist Su Yue at the Economist Intelligence Unit (EIU) said the push comes “at a critical moment marked by rising US protectionism, the expansion of sanctions, and the consolidation of a 'World-1' order” - referring to a global system increasingly decoupled from the US.

Domestically, 2023's financial anti-corruption campaign needed to conclude first, Su said.

“Without clearer conclusions or settlements on anti-corruption issues, the timing and impact of the message may be suboptimal,” she added.

Xi’s broader anti-graft campaign began in 2013, but in early 2023, the party’s disciplinary body turned explicitly to finance, vowing to “sever the link between power and capital”.

Over 2023 to 2024, it took down senior executives at Bank of China, China Life Insurance and China Everbright Group, among others.

And the campaign has not wound down.

Investigations by the Central Commission for Discipline Inspection hit a record in 2025, up nearly 31 per cent year-on-year in the first eleven months.

At its January 2026 fifth plenum, Xi said the fight remains “severe and complex”.

Lynn Song, ING's chief economist for Greater China, said the timing is “particularly ripe on the heels” of that record-breaking trade surplus - and “mounting pressure” from China's trade partners.

China's goods surplus hit a record US$1.19 trillion in 2025, up 20 per cent from 2024, according to customs data.

A stable, appreciating currency “increases its attractiveness as a reserve currency”, Song added.

The 15th Five-Year Plan (2026–2030) also shifted its language from “steadily and prudently advancing” yuan internationalisation to simply “advancing” it.

WHAT HASN'T CHANGED?

Beijing has built extensive infrastructure and the yuan is now its largest cross-border settlement currency, also the world's second-most-used in trade finance.

The Cross-Border Interbank Payment System (CIPS), the country’s alternative to the SWIFT messaging network for clearing yuan transactions, has 1,729 participants across 189 countries and processed 175 trillion yuan (about US$24 trillion) in 2024 - a 43 per cent year-on-year increase.

China currently has active swap agreements with 32 countries and regions, including the European Central Bank, South Korea and Saudi Arabia.

ING’s Song flagged recent steps - such as allowing foreign investors to conduct bond repurchase transactions in the interbank market as tangible progress.

Yet the yuan's share of global reserves fell from a peak of 2.83 per cent in early 2022 to 1.93 per cent in the third quarter of 2025, according to IMF data - dwarfed by the US dollar at roughly 58 per cent and the euro at about 20 per cent.

The yuan accounts for roughly 3 per cent of SWIFT payments, against around 48 per cent for the dollar.

Headquarters of the People's Bank of China (PBOC), the central bank, is pictured in Beijing, China. (File photo: Reuters/Jason Lee)

Headquarters of the People's Bank of China (PBOC), the central bank, is pictured in Beijing, China. (File photo: Reuters/Jason Lee)

Analysts pointed to the same constraints: capital controls - restrictions Beijing places on money flowing in and out of the country.

Capital controls allow Beijing to manage its exchange rate and set interest rates without triggering destabilising outflows - a hard lesson learnt from the 1997 Asian financial crisis, Lin said.

“There is a strong element of control where China is able to have its cake and eat it with capital controls. But the challenge is this: who wants a global currency as the trade, investment and reserve currency if China has these capital controls?”

Lin went further to illustrate the problem from a corporate perspective. A company treasurer receiving dollars can invest that cash overnight in deep, liquid markets. “China doesn't have near this wide breadth of investable opportunities for yuan cash,” Lin said.

“If you don't have an investable currency, it's less attractive to receive yuan as a payment in the first place.”

Song described similar tensions.

“Over the past few years, (China) has enjoyed the benefits of being able to tightly manage its currency, but full internationalisation means letting go of this control to an extent.”

He added that Beijing often has an “elevated perception of risk, affecting its appeal as a reserve currency”.

Su outlined the remaining steps: “providing sufficient offshore yuan liquidity, relaxing capital controls, and narrowing its trade surplus by importing more from the rest of the world”.

China's goods trade surplus hit a record US$1.19 trillion in 2025, up 20 per cent from the previous year.(Photo: Chinatopix Via AP)

China's goods trade surplus hit a record US$1.19 trillion in 2025, up 20 per cent from the previous year.(Photo: Chinatopix Via AP)

The Qiushi publication on Jan 31 signals that Beijing might be preparing to loosen, Lin said.

“In fact, it's been gradually liberalising its channel primarily through Hong Kong,” he added.

Hong Kong Chief Executive John Lee’s opening address at the 19th Asian Financial Forum on Jan 26, emphasised the city’s role as the world's largest offshore yuan hub and also announced measures to deepen market access with mainland Chinese cities - moves which Lin said was Beijing using Hong Kong to test gradual capital account opening.

“I think it's a signal, China's feeling like the upside and downside, risk versus return. It's starting to be in China's favour that maybe they can start loosening China's capital controls.”

WHAT TO EXPECT

In his 2024 speech, Xi described a currency “widely used in international trade, investment and foreign exchange markets” - one with “global reserve currency status” backed by strong Chinese influence in the “formulation of international financial rules”.

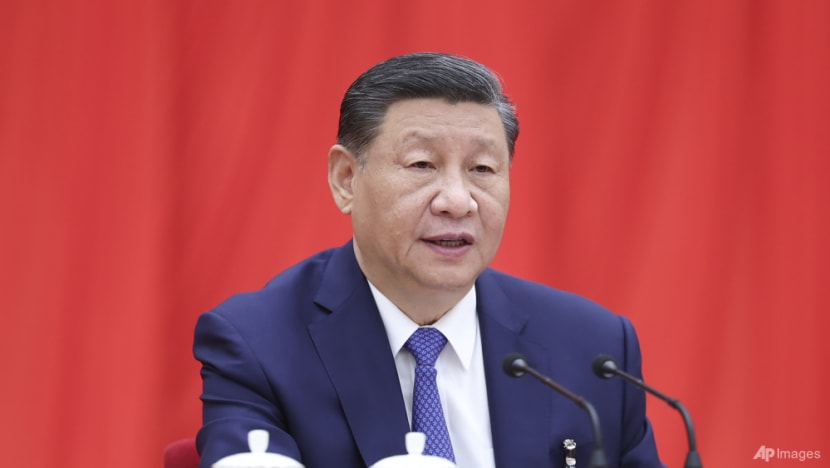

Chinese President Xi Jinping. A two-year-old speech published in the Communist Party journal Qiushi contained his most explicit call yet for the yuan to achieve global reserve currency status. (Photo: Xie Huanchi/Xinhua via AP)

Chinese President Xi Jinping. A two-year-old speech published in the Communist Party journal Qiushi contained his most explicit call yet for the yuan to achieve global reserve currency status. (Photo: Xie Huanchi/Xinhua via AP)

Next steps will be incremental, experts said.

“The Chinese government is more likely to focus on expanding currency swap arrangements with trading partners and increasing the use of yuan in trade settlement, particularly with commodity exporters,” said Su.

“Expanding yuan-denominated lending to the Global South is another likely approach,” Su said, adding that China is also positioning itself as a provider of alternative financial services - beneficial to US-sanctioned countries such as Iran.

“Mitigating vulnerability to financial coercion” also remains a challenge, said ING’s Song.

“If a country is cut off from SWIFT, is it able to continue to operate more or less as normal?”

“Maintaining relative currency stability is also conducive for internationalisation,” Song said, adding that wild swings raise costs of hedging, uncertainties, and reduce the appeal of holding the yuan as a reserve currency.

But the pace of opening is constrained by the risk of capital flight, Lin from The Asia Group noted.

“There are a lot of Chinese who would love to get their money out of the country if they could.”

If China exhausted its foreign reserves, it would lose the ability to import dollar-denominated commodities, attract FDI or defend the currency, said Lin.

That would be a “nightmare for China”, he said.

To Lin, the currency push is ultimately about more than trade or finance.

“When we talk about loosening currency, it's far more than just a way to get the world to transact with China in yuan - there is a political element,” Lin said.

As more countries adopt the yuan for investment and capital-raising, Beijing gains the ability to direct capital toward its strategic priorities - making currency liberalisation a tool of geopolitical influence, he said.

“This currency liberalisation attempt is essentially how China expands its influence across not only the trade domain or the security domain, but increasingly the currency domain as well.”

But the process will be long, he cautioned.

“I think it's likely going to happen - and China is signalling that, but it will probably be many, many years. And even now, China is very hesitant to open up the capital control.”