brand studio Advertorial

Trust+ offers the tangible appeal of a metal card – without the usual fees or barriers – along with exclusive lifestyle perks and tools to grow your savings.

Trust+ offers an elevated banking experience with a metal card, zero foreign exchange fees and one-for-one lifestyle perks. Photos: Trust Bank

New: You can now listen to articles.

This audio is generated by an AI tool.

Even in the age of digital banking, metal cards still carry a certain cachet. Their weight and finish – long associated with a sense of distinction – offer a tactile contrast to a banking experience that now mostly happens on screens.

To qualify for Trust+ and its metal card, customers must maintain at least S$100,000 each month in eligible balances.

To qualify for Trust+ and its metal card, customers must maintain at least S$100,000 each month in eligible balances.

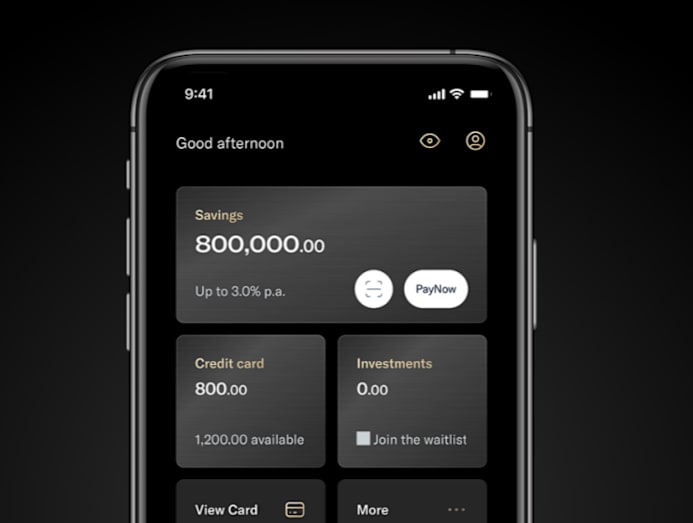

With Trust Bank’s Trust+, customers can enjoy an elevated banking experience and a metal card without the usual trade-offs such as high annual fees. They will also enjoy zero foreign exchange charges, exclusive perks like one-for-one treats and an in-app black-gold theme.

Trust Bank is Singapore’s first digitally native bank, backed by a unique partnership between Standard Chartered Bank and FairPrice Group.

EARN HIGHER INTEREST ON DEPOSITS OF UP TO S$1.2 MILLION

Trust+ applies bonus interest to higher deposit levels than most other banks, supporting a range of long-term financial goals.

Trust+ applies bonus interest to higher deposit levels than most other banks, supporting a range of long-term financial goals.

“Trust+ is designed for customers who want to grow their savings while enjoying exclusive benefits,” said Mr Aditya Gupta, chief product officer at Trust Bank. “Trust+ is part of our extensive product suite that empowers customers to meet a range of financial goals in a simple, transparent and rewarding way – whether you’re managing your spending or borrowing needs, growing your wealth or simply looking for more value from everyday banking.”

While other banks limit higher interest rates to the first S$100,000 or S$150,000, Trust+ extends its bonus interest rates to savings of up to S$1.2 million, provided customers meet the relevant criteria.

HOW TO QUALIFY FOR TRUST+

Trust+ features a sleek black-gold in-app theme, designed to complement its metal card.

Trust+ features a sleek black-gold in-app theme, designed to complement its metal card.

To qualify for Trust+, customers must maintain at least S$100,000 in eligible balances each month – either in a Trust savings account, TrustInvest account^ or a combination of both.

For instance, if your Trust savings account has an average daily balance of S$50,000, and your TrustInvest account is valued at S$50,000, you would meet the S$100,000 minimum to qualify for Trust+. Once the threshold is met, the upgrade to Trust+ is automatic – with no subscription fees or forms to complete. The in-app theme and benefits will be activated from the first day of the following month.

The average daily balance is calculated by adding up the daily balances for the month and dividing the total by the number of days. Assessment takes place on the first day of the following month.

Your TrustInvest account value is based on the cash balance and market value of your mutual funds as of the 25th of each month, or the preceding Friday if the 25th falls on a weekend.

TrustInvest offers a curated selection of funds managed by Aberdeen Investments, catering to different investment goals. These include Income+, which aims to deliver monthly dividends; Wealth+, with three varying risk levels to support long-term objectives; and Cash+, a money market fund comprising short-term investment instruments, including government securities. Income+ and Wealth+ are exclusive to Trust.

ENJOY MORE OF THE THINGS YOU LOVE

Trust+ unlocks perks like VIP support and exclusive deals at Starbucks, Mandai Wildlife Reserve, Golden Village and more.

Trust+ unlocks perks like VIP support and exclusive deals at Starbucks, Mandai Wildlife Reserve, Golden Village and more.

Besides boosting the returns on your savings, Trust+ unlocks a range of lifestyle perks – including one-for-one deals at Starbucks, Paradise Group and the Edge buffet at Pan Pacific Singapore. Other benefits include a complimentary one-year membership at Just Wine Club, 50 per cent off admission to Mandai Wildlife Reserve and one-for-one Gold Class movie tickets at Golden Village.

Trust+ customers also enjoy 24/7 VIP support, with priority access to customer care via the Trust app.

“We are excited to elevate our Trust+ offering, making it even simpler and more rewarding for our customers,” said Mr Gupta. “With curated privileges and dedicated support, we’re confident Trust+ delivers more value and convenience as our customers grow their savings with us.”

Visit Trust Bank to find out how to qualify for Trust+.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

^TrustInvest is an investment product and not a bank deposit. All investments are not insured by the Singapore Deposit Insurance Corporation. All investments involve risks, including the possible loss of all or part of your original investment amount. Past performance is not indicative of future performance.

This information is not an offer or recommendation to buy or sell units in the fund. It does not consider your specific investment objectives, financial situation or needs. You should get advice from a financial adviser or consider whether the investment is suitable for you before making any investment decisions.