The authorities said last month that financial influencers, or finfluencers, must be licensed and regulated if they provide financial advice.

Ms Dawn Cher, known as SG Budget Babe, in an Instagram video.

New: You can now listen to articles.

This audio is generated by an AI tool.

SINGAPORE: Ms Dawn Cher has been dishing out personal finance management tips on the internet for more than 10 years.

The 34-year-old, better known as SG Budget Babe, has more than 30,000 followers on various social media platforms like Instagram and YouTube. Her follower count got a major boost post-pandemic as more Singaporeans looked to take charge of their own finances.

But last month, a question was raised in parliament over whether such financial influencers should be regulated under the Financial Advisors Act (FAA).

Calls to regulate online finance-related content have been picking up pace in Singapore amid a growing number of such “finfluencers”, who share tips and insights on social media about finance-related topics like budgeting and investing.

Minister of State for Trade and Industry Alvin Tan, who is also a board member of the Monetary Authority of Singapore (MAS), responded that such influencers who provide financial advice must be licensed and regulated under the FAA.

He revealed that over the past five years, the central bank has received an average of fewer than five complaints every year against finfluencers.

Most of these complaints were about remarks made by individuals who were not giving financial advice, and thus not subject to MAS regulation.

RISK OF “HEFTY LOSSES”

Following the parliament sitting, the Consumers Association of Singapore (CASE) told CNA on Dec 10 that it is reaching out to the central bank with plans on raising awareness among those who follow such content online.

Given that the sector is unregulated, consumers are at risk of hefty losses if they act based on poor financial platforms or products that are promoted by finfluencers, said CASE president Melvin Yong.

The Radin Mas MP had been the one to ask in parliament about regulation of the finfluencer sector and the number of complaints MAS has received against finfluencers.

Mr Yong noted that finfluencers wield “significant influence” among viewers, which means it is vital for them to be “subject to greater scrutiny”.

“This is especially important as finfluencers frequently state that they are not dispensing financial advice, but proceed to talk about financial products and financial platforms regardless,” he said.

WHAT IS CONSIDERED FINANCIAL ADVICE

In an email seen by CNA, the MAS said it has updated the frequently asked questions section on the FAA.

This clarifies that financial influencers need to do a two-stage test to evaluate whether their activities are considered financial advice.

The first stage looks at whether a finfluencer has the intention to persuade someone to buy, sell or hold investments, or whether they are simply stating their opinion. The next step is to look at whether their content is tailored or if they recommend specific actions to take.

In the second stage, the regulator will examine if finfluencers provide financial advice systematically - that is, in a proper and logical manner - or if they are remunerated for doing so.

If the answer is yes to all stages, the financial influencer will be required to get a licence. Otherwise, the content will be deemed as more likely to be financial education and will not require a licence.

Mr Tan had said those who are paid for recommending or expressing an opinion on the buying, selling or holding of investment products will be considered as providing financial advice.

He told parliament that even those who do not receive money in return will be considered to be doing so if they make such recommendations or expressions regularly.

The posting of “general educational content” is not financial advice, he added.

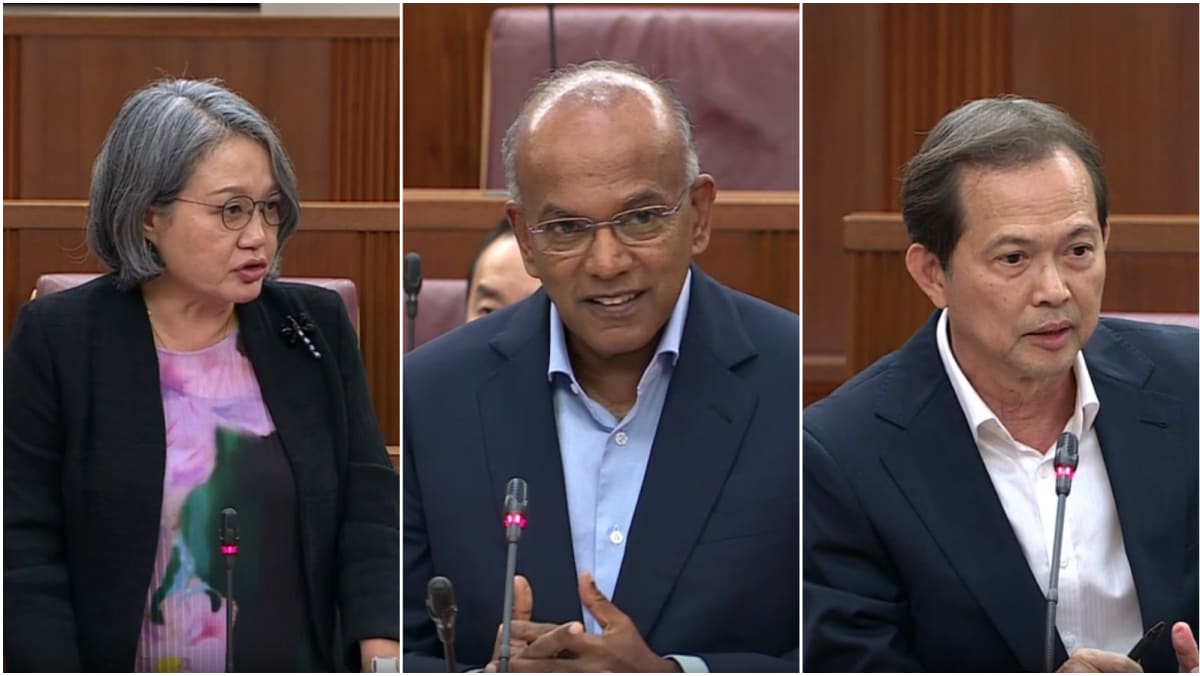

Over the past five years, the Monetary Authority of Singapore (MAS) received an average of less than five complaints a year against online "finfluencers". Most of these complaints relate to remarks made by "finfluencers" who were not providing any financial advice and hence were not subject to regulation by MAS. MAS Board Member Alvin Tan, who gave this update in reply to an MP’s questions in Parliament on Wednesday (Nov 13), said MAS and the Commercial Affairs Department will take enforcement action against individuals providing financial advice without a licence. Over the past three years, enforcement action has been taken against six individuals, none of whom were "finfluencers", he added.

FINFLUENCERS SEEK CLARITY

Ms Cher and other finfluencers turned to the authorities for clarity after last month’s parliament session.

They said that despite the low number of complaints against them, sponsors began pulling the plug on collaboration projects.

Worries surfaced among the community about whether such work, some of which was nearly ready to be published online, would all go to waste.

“And if you don't publish, then what would be the arrangement? Do you even get paid and compensated if the piece doesn't go out?” Ms Cher told CNA.

“For some ‘finfluencers’, they work a lot with brand deals and that's their rice bowl, so imagine all that anxiety just overnight. Is the rice bowl going to be gone?”

She said that when she approached MAS for clarification, she asked whether financial influencers like herself need to be licensed, and whether they are considered to be providing financial advice.

Ms Cher said she told the regulator that she and others in her industry never accepted money from followers to invest on their behalf.

“We don't sell insurance, which you need a licence for. We don't sell them an investment plan. We just talk about the pros and cons and break down how these things work, and it's on our audience to make the decisions for themselves,” she added.

She said MAS then responded a few days ago that they do not have to get licensed.

“They updated one of their latest communications to put in an FAQ specifically to address this question about finfluencers,” she added.

Ms Cher said she thinks this will lead to more accountability in the community and more people being cautious and balanced about their content.

“I think it goes to show that MAS is watching,” she noted.

“If we do something that will be a systematic risk – if you are irresponsible in your messaging; you do something that you’re supposed to have a licence for, but you don’t – you will get caught eventually.”

ENFORCEMENT ACTION NOT AGAINST FINFLUENCERS

According to Mr Tan, enforcement action – carried out by MAS and the police’s Commercial Affairs Department – was taken against six individuals over the past three years for providing financial advice without a licence.

None of these six were financial influencers.

Mr Ng Eng Beow, president of the Insurance and Financial Practitioners Association of Singapore, said this past enforcement action was aimed at preventing the financial influencing world from getting “out of hand”.

He pointed out that the risk of relying on finfluencers is that they provide “generic information”.

“Financial planning is a long-drawn process. It’s like when we go and see a doctor, the doctor may ask questions like ‘What’s your family history?’” he added.

Financial practitioners sit for at least four examinations before getting licensed, Mr Ng noted. MAS also conducts checks to see if applicants have committed any crimes in the past and what their financial health is like, among other things.

“Financial influencers – probably they just (give some) information without in-depth understanding. And probably for some, they may even (contradict) the advice given by a fully professional licensed financial practitioner,” said Mr Ng.

Stock photo of a financial advisor with a client. (Photo: iStock)

Stock photo of a financial advisor with a client. (Photo: iStock)

The association hopes for more regulations in the long run.

Mr Ng flagged the need to assess how much influence a finfluencer has on the public when they give advice. If this impact grows and complaints rise, liability may fall on the financial influencer, he said.

“In future, it will be best that they are licensed so that they will have an indemnity, or should any court case go against them, they are properly indemnified, and they know what the liabilities that they are exposed to,” added Mr Ng.

CASE’s Mr Yong said he hopes financial influencers can work with the consumer watchdog to “uplift the standards of this growing sector”.

He noted that they “play an important role in spreading awareness of finance-related topics and in improving personal finance literacy among their audience”.

“Together, we can promote financial literacy while safeguarding the interest of vulnerable consumers,” he added.

.jpg?itok=HVcXoYme)