SINGAPORE: The Civil Aviation Authority of Singapore (CAAS) has set up a new entity to centrally procure sustainable aviation fuel and secure a more affordable, stable supply for Singapore and the region.

CAAS announced on Thursday (Oct 30) that the Singapore Sustainable Aviation Fuel Company (SAFCo) has been formed to support the implementation of Singapore’s national sustainable aviation fuel policy.

SAFCo will help Singapore meet its goal for sustainable fuel to account for 1 per cent of all jet fuel used at Changi and Seletar airports in 2026, rising to 3 to 5 per cent by 2030, CAAS said in a statement.

Director-general of CAAS Han Kok Juan, who will chair SAFCo, told journalists at a media conference that the company will bring together stakeholders such as airlines, fuel producers and carbon market platforms to “get them organised”, which could indirectly lower fuel costs.

“If we have an aggregated and a more efficient way of procuring sustainable aviation fuel, we are able to send a stronger demand signal to producers,” he said.

“That would hopefully stimulate investments and production, and therefore have a dampening effect on prices.”

Last year, CAAS estimated that sustainable aviation fuel costs around three to five times more than conventional jet fuel.

Former global head of marketing and sustainability at Shell Low Carbon Solutions, Ms Tan Seow Hui, has been appointed SAFCo’s chief executive officer.

Responding to a question about how SAFCo’s approach differs from current procurement practices, she said the company allows for purchasing at a greater scale.

“(SAFCo) will give us a certain scale in terms of the ability to anchor longer term and bigger contracts, give us the ability to negotiate for more competitive prices versus any individual airline or companies are able to do so,” she said.

PROCUREMENT AND FUNDING MODEL

Mr Han said procurement, targeted to begin in 2026, will be carried out through a “transparent, competitive tender process” involving suppliers that meet international sustainability standards.

SAFCo has begun engaging businesses and airlines interested in the procurement mechanism, with discussions ongoing.

In its first year, the company plans to hire about 10 staff members, with headcount to be “gauged and sized accordingly thereafter”. It is also in the process of looking for office premises. Initial startup costs will be fully funded by CAAS.

The establishment of SAFCo follows the recent passage of the Civil Aviation Authority of Singapore (Amendment) Bill, which empowers CAAS to collect a sustainable aviation fuel levy and appoint a central procurement entity.

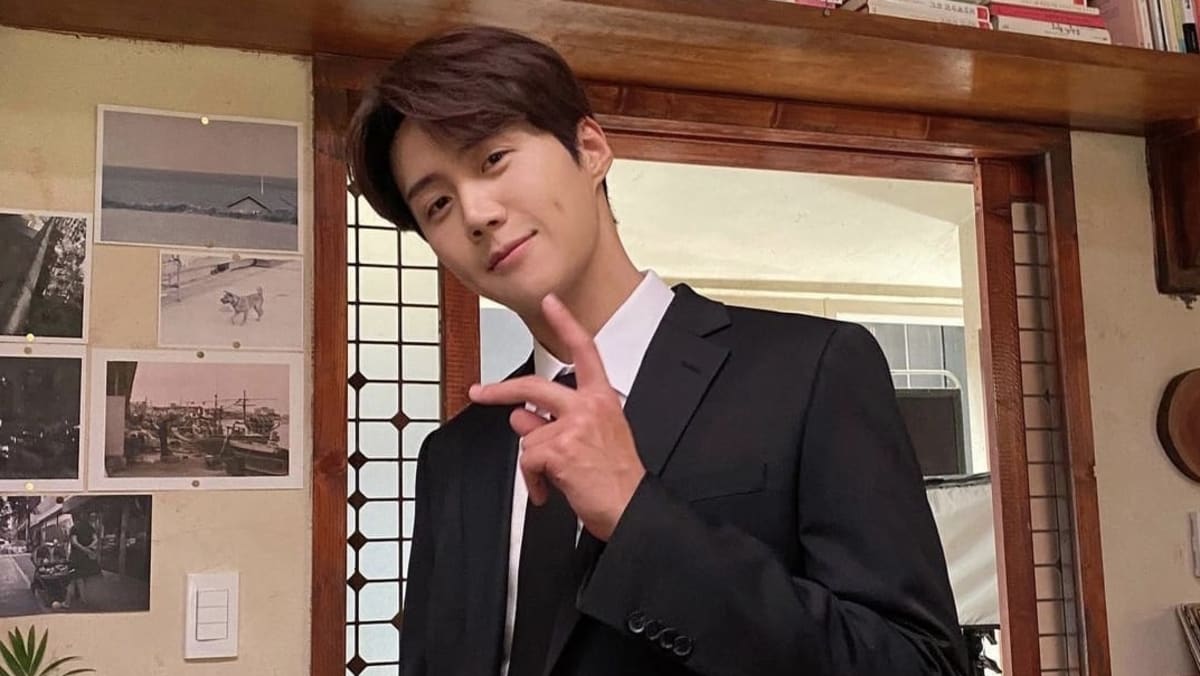

Director-general of the Civil Aviation Authority of Singapore Han Kok Juan on Oct 30, 2025. (Photo: CNA/Lim Li Ting)

Director-general of the Civil Aviation Authority of Singapore Han Kok Juan on Oct 30, 2025. (Photo: CNA/Lim Li Ting)

A key priority will be setting up a system to collect levies from passengers. Levies collected will go into a fund used to purchase sustainable aviation fuel.

Preliminary CAAS estimates last year suggested that economy-class passengers may pay an additional S$3 (US$2.32) for short-haul flights, S$6 for medium-haul flights and S$16 for long-haul flights.

“For example, if there is a S$3 levy for a short-haul flight to Bangkok with 100 people, then S$300 in levies will be collected, and go into the fund, and that money will be used to buy sustainable aviation fuel,” said Mr Han.

However, he noted that details on levy collection and final levy charges are still being finalised and will be announced later.

TARGET NOT A MANDATE

Mr Han emphasised that the 1 per cent target is not a mandate, and that the actual proportion could be higher or lower depending on market prices.

He said SAFCo will adopt a “fixed cost envelope approach”, meaning it will spend a predetermined amount on sustainable aviation fuel regardless of prevailing prices.

“If tomorrow, the price of coffee increases, I will still spend S$2. What it means is that I don’t drink a full cup, I drink a bit less than a full cup.”

Similarly, while the target is 1 per cent, the actual proportion will depend on sustainable aviation fuel prices at the time of procurement.

“This is very different from a system where ‘I want to buy a cup of coffee regardless of what the price of coffee is’,” Mr Han said, adding that the approach is designed to manage volatility.

“The market is still very nascent, the price is volatile … we want to be able to cap our exposure for the entire aviation ecosystem.”