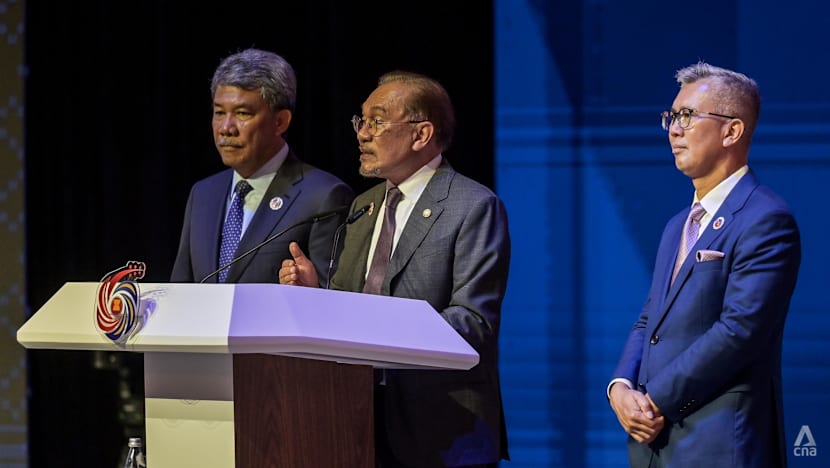

Malaysia’s Prime Minister Anwar Ibrahim (centre) speaks during a press conference after the 47th ASEAN Summit ended in Kuala Lumpur on Oct 28, 2025. His government faces a delicate challenge in boosting investor sentiment as foreign funds exit the country's stock and bond markets. (Photo: CNA/Fadza Ishak)

Malaysia’s Prime Minister Anwar Ibrahim (centre) speaks during a press conference after the 47th ASEAN Summit ended in Kuala Lumpur on Oct 28, 2025. His government faces a delicate challenge in boosting investor sentiment as foreign funds exit the country's stock and bond markets. (Photo: CNA/Fadza Ishak)

New: You can now listen to articles.

This audio is generated by an AI tool.

KUALA LUMPUR: The Malaysian economy is not at risk of hitting any major bumps in the coming months, but the country’s tepid growth prospects and cautious political outlook are why foreign investors have been pulling out from its financial markets, economists and analysts say.

As of Sep 30, net portfolio equity outflow from the Malaysian stock market this year hit RM16.4 billion (U$3.9 billion), about four times the full-year outflow of RM4.2 billion in 2024, said RHB Research in a note earlier this month.

According to Bank Negara - the country’s central bank - the non-resident outflow from the stock market in 2023 was RM2.3 billion.

Foreign shareholding now stands at around 19 per cent of total market capitalisation and is at an all-time low, CIMB Research was quoted as saying in reports this month. The shareholding ratio has fluctuated between 22 per cent and 23 per cent for some years.

Bonds are bleeding too: September saw RM6.8 billion in net foreign selling, reversing a brief inflow in August, according to RAM Rating Services.

RAM added in a note last week that foreign holdings in Malaysian bonds have already edged lower in the first half of this month, falling to RM285.8 billion as at Oct 14, down from RM287.0 billion as at end September.

Bank Negara figures show that foreign holdings stood at about RM275 billion at the start of January, rising to a high of RM302 billion at end May this year, before retreating to current levels.

“It is a worrying trend,” former finance minister Tengku Razaleigh Hamzah told CNA of the haemorrhaging of foreign capital from the Malaysian financial markets.

“It is clear that foreign investors don’t have an upbeat long-term view on Malaysia, (with) little faith in … the management of the economy,” he added.

The exodus of foreign portfolio capital is a region-wide phenomenon because of the uncertainty in the international economy and concerns over new tariffs that the United States government has been threatening, investment analysts said.

Indonesia, Philippines and Thailand are also losing portfolio money from a broad cross-section of portfolio investors, comprising private equity interests, hedge funds, and large international pension and insurance companies.

But Malaysia’s outflow has been one of the sharpest among members of the Association of Southeast Asian Nations (ASEAN), raising serious concerns at a time when competition for limited overseas capital is becoming more intense among regional economies.

SLOWDOWN

The Malaysian economy, ASEAN’s fifth-largest, is expected to grow at a slower pace of around 4.2 per cent next year, down slightly from the projected 4.5 per cent expansion in gross domestic product (GDP) this year, according to Kenanga Research.

The lukewarm outlook is despite the country’s success in attracting direct investments in key sectors of the economy.

According to the Malaysian Investment Development Authority (MIDA), the country attracted RM378.5 billion of approved investment in 2024, up 14.9 per cent from the previous year.

For the January to June period this year, MIDA noted that approved investment hit RM190.3 billion, up 18.7 per cent from the same 2024 period.

Economists noted that the biggest challenge facing Prime Minister Anwar Ibrahim’s government is the rising tensions between the short-term requirement for lifting growth and the long-term need for fiscal consolidation.

This awkward predicament is largely due to the budget deficits going back over two decades that successive administrations have accumulated.

The pattern of the government spending more than it earns will continue into next year, as highlighted in the 2026 federal budget that Anwar, who is also Finance Minister, unveiled on Oct 10 in parliament.

The government has earmarked RM338.2 billion as operating expenditure and RM81 billion for development.

Malaysia will be running a fiscal deficit that is set to amount to around 3.5 per cent of national economic output, according to official statements in the Federal Government budget.

SENTIMENT

“It is very much a question of sentiment. When the economy isn’t humming, then investors start looking at other trouble spots, such as politics," former Law Minister Zaid Ibrahim said.

To be sure, the Malaysian political climate has come a long way from a protracted period of turbulence following the May 2018 general election that saw the ejection of the long-established Barisan Nasional (National Front) coalition from government.

That in turn led to a revolving door of fragile administrations with three prime minister changes within four years.

Since assuming the premiership in November 2022 after an inconclusive general election, Anwar has successfully presided over a so-called unity government comprising several coalitions led by his Pakatan Harapan alliance.

But analysts noted that the current administration is fragile and remains exposed to potential upheavals should any group choose to defect.

“This is not one coalition leading the government but a coalition of coalitions. That makes Anwar’s position very weak,” said Khoo Boo Teik, a veteran academic and the author of several political books on Malaysia.

Sabah Chief Minister Hajiji Noor, a close ally of PM Anwar, is leading his coalition into a crucial state assembly election later this month, a poll that could have major implications for Malaysia's economy and politics. (Photo: Facebook/Hajiji Haji Noor)

Sabah Chief Minister Hajiji Noor, a close ally of PM Anwar, is leading his coalition into a crucial state assembly election later this month, a poll that could have major implications for Malaysia's economy and politics. (Photo: Facebook/Hajiji Haji Noor)

Analysts are closely watching the developments in the east Malaysian state of Sabah, which will hold fresh state assembly polls on Nov 29.

While the current term of the Anwar administration expires only in late 2027, with a general election due by February 2028, several analysts noted that how the polls play out in Sabah could determine whether national polls are called earlier, possibly in late 2026.

Politics in Sabah has turned restive in recent months with public unease over a scandal involving the award of mining rights in the state to groups closely linked to Anwar, and dissatisfaction among the youth over rising unemployment and the state’s weak economic prospects.

Should the current state government, which is aligned to Anwar’s unity government, get ousted in the upcoming polls, analysts said that a fresh round of political horse-trading to form a new state government could have realignment implications at the national level.

“Sabah always delivers surprises and this time the ground is moving against the current powers. There could be a period of instability because forming coalitions will be difficult with so many groups competing,” said a Kuala Lumpur-based media trainer, who spent several weeks in the state to coach local journalists on the upcoming election coverage.

STRUCTURAL ISSUES

Politics and flagging investor confidence aside, Bursa Malaysia is plagued by its own set of structural problems and lack of government attention that have contributed to the market’s stagnation over the last decade, said stockbrokers and investment analysts.

The Malaysian stock exchange is no longer viewed as competitive compared to its regional peers because of the lack of quality listings in the technology sector and high-growth stocks.

Bursa Malaysia is dominated by large companies, particularly financial institutions and plantation companies, that are majority owned by government-linked institutions, a feature that investment analysts noted dilutes the exchange’s appeal with foreign investors who like markets with high levels of liquidity and robust trading.

Another major challenge facing the stock market is concerns over corporate governance and regulation that industry executives noted has been compromised in the past when alleged transgression of market rules involved politically well-connected companies and stock controlled by government-linked entities.

“Over the years, the Malaysian market has gained a reputation where politically connected companies can escape disclosure or punishment. It is hard to change that perception,” said a chief executive officer of a large regional private equity investment company who declined to be named.

In the meantime, the outflow of funds continues.

Muhamad Irfan Norazly of MBSB Investment Bank noted that foreign investors were net sellers on every trading day last week, posting net outflows of RM962.8 million.

Local institutions, such as the Employees Provident Fund, continued to prop up the local stock market, recording purchases in stocks and other equities of RM1.3 billion last week, he said.

RHB Research has cautioned that Malaysia could be vulnerable to outflows of foreign capital should domestic risks and the external environment worsen, given the high foreign ownership levels in the domestic debt market.

“This could result in the weakening of the ringgit, reduced domestic liquidity, higher yields and steeper funding costs for the Government,” it added in its note on Oct 7.

Economist Anthony Dass of FSG Advisory told CNA that the Anwar administration needs to accelerate structural reforms in the economy and improve governance in the regulatory system if the shine is to be brought back to the country’s financial markets.

“We need to see improvements in corporate earnings and efforts to ensure a stable policy path together with a shift from commodity companies and low-value listings to stocks that are in higher-margin sectors,” he said.