Prices of luxury items can go up as much as 10 per cent if US President Donald Trump goes through with imposing tariffs, says our guest this week.

.jpg?itok=Rk6yAREG)

New: You can now listen to articles.

This audio is generated by an AI tool.

US President Donald Trump’s threats to impose tariffs could raise prices but his pro-growth policies could work for your investments. Abel Lim, head of wealth management advisory and strategy at UOB shares his insights on this week’s Money Talks.

Here's an excerpt of the conversation:

Andrea Heng (host):

Abel, how will this second Trump presidency affect the money that's in our bank accounts and in our investment portfolios?

Abel Lim, head of wealth management advisory and strategy at UOB:

Tariffs (are) inflationary in nature. It makes the cost of imports higher, which means ... the cost of Chinese goods and external imports (will increase) and consumers in the United States will have to pay the additional percentages which is being applied. That introduces inflation.

That said, we expect Federal fund target rate to reach about 4 per cent for the first half of this year, which also means that our three month SORA projection to be about 2.41 per cent. That is going to translate to higher interest rates, so higher borrowing costs, which is going to impact both individuals and corporations alike.

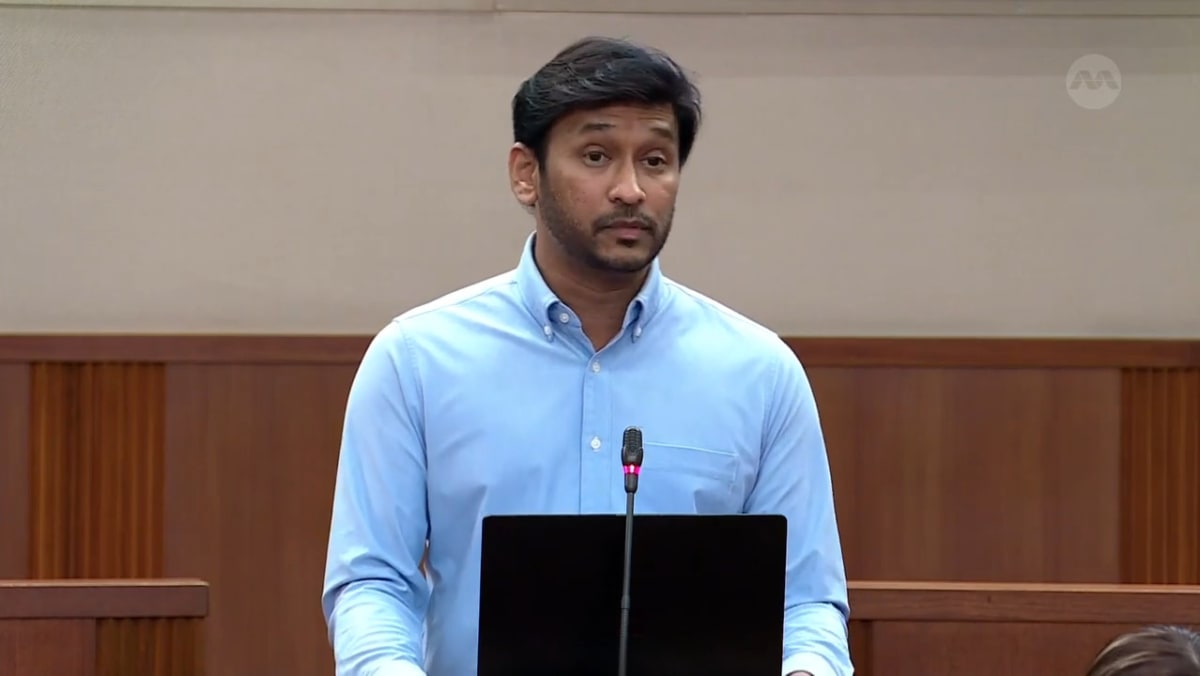

A screenshot of Abel Lim, head of wealth management advisory and strategy at UOB, speaking to host of the Money Talks podcast Andrea Heng.

A screenshot of Abel Lim, head of wealth management advisory and strategy at UOB, speaking to host of the Money Talks podcast Andrea Heng.

Andrea:

But the higher interest also means healthier portfolios, especially if you're buying into things like bonds and treasury yields, right?

Abel:

That's a very good point. So yes, yields will stay higher for longer, from our current standpoint, which is an excellent opportunity for investors who have not locked in investment grade bond yields yet to get into the market right now.

.png?itok=erLSagvf)