SINGAPORE: The Monetary Authority of Singapore (MAS) has appointed three asset managers under the Equity Market Development Programme, it announced on Monday (Jul 21).

The asset managers will initially manage S$1.1 billion (US$856 million) out of the S$5 billion fund, and MAS is still reviewing submissions from more than 100 global, regional and local firms.

Avanda Investment Management, Fullerton Fund Management and JP Morgan Asset Management are the first three managers to be appointed, MAS said in an update to its earlier announcement in February.

At that time, the MAS announced the S$5 billion programme that involves putting money with fund managers focused on investing in Singapore stocks.

These managers are expected to actively manage investments in a range of companies and draw in investments from other investors.

The programme was proposed by a review group established in August 2024 to strengthen Singapore's stock market and aims to complete its work by the end of 2025.

MAS said it has received strong interest in the Equity Market Development Programme, and is reviewing applications in batches to speed up the appointment and capital deployment process.

The factors taken into consideration were the alignment of their proposed fund strategies with the programme's objectives, the strength of their proposals to "crowd in" third-party capital and their commitment to expand or contribute to the growth of the asset management and research capabilities in Singapore.

"In particular, the fund strategies should have a clear focus on improving liquidity and broadening participation in Singapore equities, with significant allocation to small and mid-cap stocks," MAS said in a press release.

Deputy chairman for MAS Chee Hong Tat said: "The MAS team is currently assessing many other proposals that have come in, and we wanted to go with these three first because they are ready.

"We thought it would be better for us to proceed with these three while we continue to assess and work with the other asset managers, rather than to hold back all the proposals and finish assessing all of them before we announce the full list, so we'll take it in stages."

The next phase of selection is expected to be announced by the fourth quarter of this year.

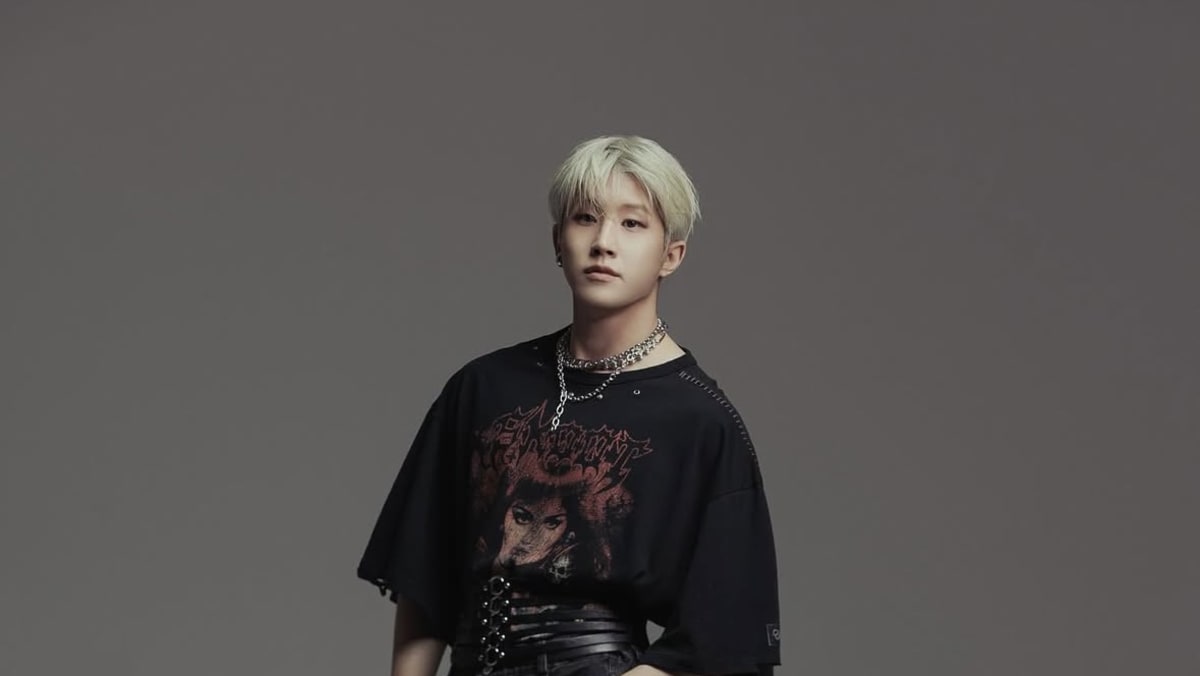

National Development Minister Chee Hong Tat, who is also deputy chairman of the Monetary Authority of Singapore (MAS), speaking on Jul 21, 2025. (Photo: CNA/Faith Ho)

National Development Minister Chee Hong Tat, who is also deputy chairman of the Monetary Authority of Singapore (MAS), speaking on Jul 21, 2025. (Photo: CNA/Faith Ho)

"By investing with a broad range of fund managers employing varied strategies, the (programme) can leverage their distinct investment expertise and distribution networks to attract commercial capital and strengthen market vibrancy," the central bank added.

SGX Group CEO Loh Boon Chye said the review group has made important progress in catalysing active institutional capital into Singapore's equities market, and its approach aligns with SGX's push to broaden market participation, expand offerings and attract quality listings.

"Momentum is building in our stock market beyond index names and in our listing pipeline – but this is just the start. With collective efforts across the ecosystem, we can unlock stronger, more sustained capital flows," said Mr Loh.

The Straits Times Index is up around 11 per cent from the start of the year, having recovered from the turmoil in April after trade tensions escalated.

However, in recent years, Singapore's stock market has struggled with poor valuations, limited liquidity and a lack of new listings.

Prime Minister Lawrence Wong said in his Budget 2025 speech that he would introduce tax incentives for Singapore-based companies and fund managers that choose to list here.

Mr Wong also said there would be tax incentives for fund managers who invest substantially in Singapore-listed equities, in order to encourage more investment in local capital markets.

S$50 MILLION FOR EQUITY RESEARCH

MAS also said on Monday that it would set aside S$50 million from the Financial Sector Development Fund to enhance the Grant for Equity Market Singapore (GEMS) scheme.

This is part of the review group's earlier recommendation to shift toward a more disclosure-based regime.

"In tandem with this shift, it is important to enhance the quality of equity research as a complementary measure," MAS said, adding that it will facilitate price discovery and fair valuation of companies, enabling investors to make informed decisions.

The industry has also given feedback that research coverage in the small- and mid-cap segment could be improved.

Besides contributing S$50 million in funding, the GEMS scheme will also be extended by two years to the end of 2028.

Each research report can receive an additional S$1,000, while those that initiate research coverage or cover pre-initial public offering stage and newly listed companies can receive a further S$1,000.

This brings the maximum funding per report from S$4,000 to S$6,000.

There will also be new grant funding to defray costs of research dissemination through digital media and to support research on private companies with strong local presence.

The listing grant under GEMS will also be expanded to cover Singapore Depository Receipts and Foreign Depository Receipts with underlying Singapore stocks, as well as the listing of primary listed exchange-traded funds (ETFs).

MAS said S$40,000 will be provided per depository receipt issuance, and S$100,000 to S$250,000 per primary listed ETF. Cross-listed and feeder ETFs can also receive S$180,000 per listing

For investors, MAS will be strengthening protection by enhancing recourse avenues.

Based on feedback that retail investors face difficulty in commencing civil action, the regulator will consult on proposals covering three areas – enabling the pursuit of legal action, facilitating self-organisation and providing access to funding.

MAS will consult on proposals to enhance legal provisions to enable investors to ride on court action or civil penalty to seek compensation, to allow representatives to organise and carry out legal action on behalf of investors and on setting up a grant scheme to defray the cost of taking legal action for cases involving market misconduct.

An SGX sign is pictured at the Singapore Stock Exchange on Jul 19, 2017. (File photo: Reuters/Edgar Su)

An SGX sign is pictured at the Singapore Stock Exchange on Jul 19, 2017. (File photo: Reuters/Edgar Su)

Mr Chee, who is also national development minister, said the proposals seek to strike a balance between making it easier for investors to seek recourse in genuine cases, versus avoiding an overly litigious operating environment where lawsuits increase the operating cost for companies.

He also outlined other strategies that the review group is studying, including how companies can engage shareholders better, enhance the attractiveness of the SGX's Catalist board and promote retail investor participation.

The review group is also looking at board lot sizes and how to encourage collaborations with overseas exchanges to facilitate cross-border trading and listings.