JAKARTA: When Resty Kinanthi arrived at a gold shop in South Jakarta at 8am on a recent weekday eager to buy a few grams of the precious metal, she was quickly turned away.

The 24-year-old, who is currently unemployed, had heard of the growing gold trend gripping the country in recent weeks so she turned up early, an hour before the shop opened.

Still, she was too late. A 50-person quota had been in place to buy gold since April and it was already full.

She went back the following day at 6am but it was the same story.

“I wondered: Why? At what time do people even arrive? I asked around and was told that a lot of people came the night before to get a number to queue for the quota,” she said.

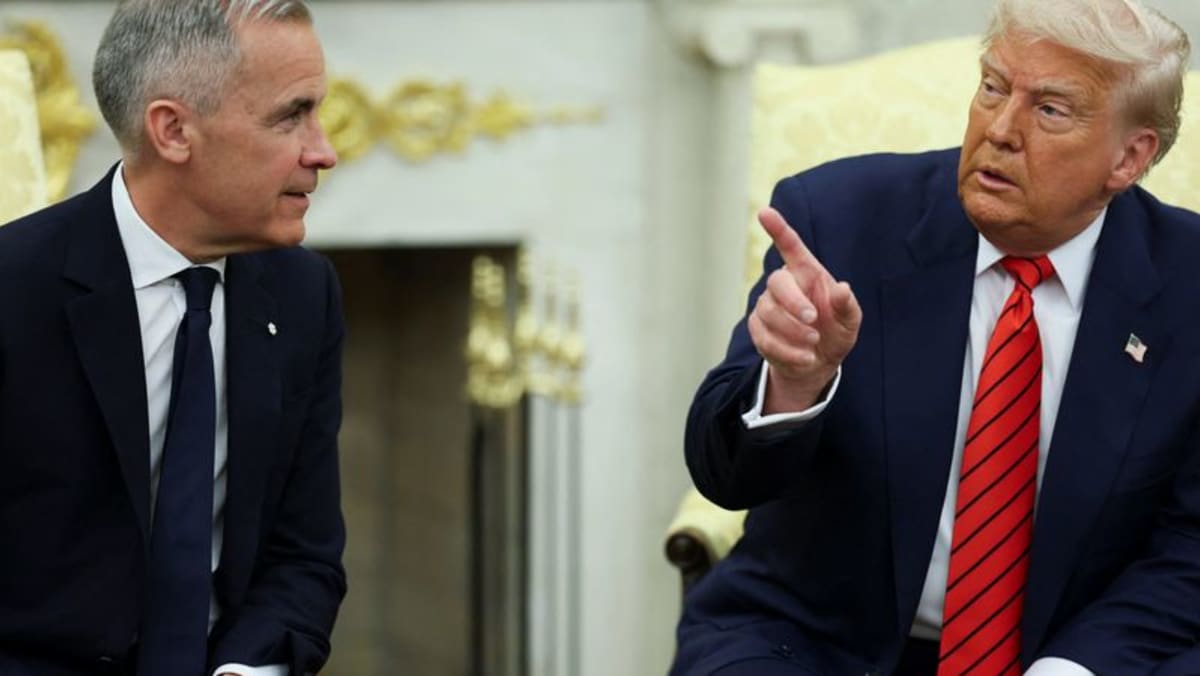

With gold hitting an all-time high, an economic slowdown in Indonesia, and concerns about how United States President Donald Trump’s tariffs will affect the world’s economy, many Indonesians have been rushing to buy gold, even if it means queuing the night before the shop opens.

While gold fever has happened before in the country, most recently during the COVID-19 pandemic, the current craze has reached new heights, say experts, as they remind consumers to be cautious of the volatile economic situation.

WHY ARE PEOPLE QUEUING?

In Indonesia, the queue to buy gold began slowly months ago when Trump was about to return to power, said economist Eko Listiyanto from the Institute for Development of Economics and Finance (INDEF). But it has intensified in recent weeks after Trump’s tariff announcement.

The US announced a 32 per cent tariff on imported Indonesian goods on Apr 2, which Trump declared “Liberation Day” due to the sweeping group of tariff announcements on various countries, before declaring a 90-day-pause on Apr 9 on “reciprocal” tariffs on imports from almost 60 countries.

After Liberation Day, the gold price globally and in Indonesia soared as it is widely seen as a safe haven hedge against the economic uncertainties caused by Trump's moves.

Gold bullions on display at a gold shop in Jakarta. (Photo: CNA/Ridhwan Siregar)

Gold bullions on display at a gold shop in Jakarta. (Photo: CNA/Ridhwan Siregar)

As of Apr 28, the global price of gold is about US$3,338 per ounce (around 28 grams), while in Indonesia it was 1.965 million rupiah (US$117) per gram.

This is about a 10 per cent increase compared to one month ago when it was 1.79 million rupiah.

Other countries in the region have also reported seeing symptoms of gold fever.

In Malaysia, some stores reported a 25 per cent increase in customers, according to local media.

Vietnam has also reported long queues outside stores to buy gold.

In Thailand, where gold also retains strong cultural significance, younger generations are entering the market through social media-driven financial advice. As a result, gold-trading apps and platforms are flourishing.

There were however no reports of people queuing overnight in these countries as seen in Indonesia.

While some people in Indonesia may understand that the high gold price is related to Trump’s Liberation Day, others may not, said Eko.

He added that as the cost of living in Indonesia has also gone up, people want to prepare for rainy days.

Furthermore, some people may still have money left from their Eid religious allowance, which employers handed to their staff towards the end of March, and they think it’s best to spend it on gold.

Eko said that many who queue for gold lately are young people such as Resty, and the high demand may be because Gen Z and millennials are financially more literate than older generations in Indonesia.

“Gen Z and millennials may not have a lot of money, but they are starting to invest earlier than previous generations,” Eko added.

He also said that because the two generations are digitally connected, they tend to have a heightened fear of missing out (FOMO).

Economist Fithra Faisal from securities brokerage firm Samuel Sekuritas Indonesia shared the same view.

He also said that because many Indonesians live from paycheck to paycheck, they want to gain an advantage from the current situation, as a hike in gold price seems like an easy way for them to buy and then resell quickly to profit.

“Because there is the potential that the gold price will increase further - three weeks ago it was 1.7 million rupiah per gram, then 1.8 million rupiah, then 1.9 million, then 2 million, they want to benefit from it.”

An employee of a gold pawn store arranges gold jewellery. (Photo: CNA/Ridhwan Siregar)

An employee of a gold pawn store arranges gold jewellery. (Photo: CNA/Ridhwan Siregar)

A LONG-STANDING STATUS SYMBOL

Besides Gen Z and millennials, some who queue are women from older generations.

Fithra said that these women from lower-income groups may not have a bank account, and their way to save up is by buying gold.

Social researcher Devie Rahmawati from the University of Indonesia said that, generally, gold has played a crucial role in Indonesian society for a long time.

In many Indonesian cultures, older generations grew up being told to have gold, not just as an investment, but also as a symbol of social status.

“Gold is a symbol of prosperity, power, and happiness,” said Devie.

“This is perhaps nowadays replaced by the cars people use or their mobile phones, but the older generation, especially women, tend to have gold and even pass theirs down to the next generation.”

However, places to purchase gold are limited.

In Southeast Asia’s largest economy, gold bullion - gold in the form of bars or coins - is mainly sold by the state-owned mining company Aneka Tambang (ANTAM), which has only a few shops in Jakarta and a few other major cities in Indonesia.

There are only a handful of smaller ones, and most people prefer gold of ANTAM as the London Bullion Market Association guarantees it and it is easier to resell.

An employee of an ANTAM gold shop in Jakarta serving customers who want to sell or resell gold. (Photo: CNA/Ridhwan Siregar)

An employee of an ANTAM gold shop in Jakarta serving customers who want to sell or resell gold. (Photo: CNA/Ridhwan Siregar)

With not many options for people to buy bullion gold in its physical form exist, ANTAM could struggle to meet the demand, said observers.

“ANTAM cannot just suddenly increase its production,” said Eko.

“This makes the queues long.”

ANTAM told CNA it aims to make the metal available as much as possible.

It currently has five outlets in Jakarta and about 15 nationwide.

"We have anticipated this condition by strengthening the supply chain and optimising our distribution network, including our boutiques in various regions, and also presenting a digital solution for purchasing gold through ANTAM’s application," said ANTAM corporate secretary Faisal Alkadrie.

While acknowledging the increase in gold demand, he did not reveal figures on this as well as on how much ANTAM sells daily.

Economist Eko also said that the situation in Indonesia could be the same in regions with similar cultural attitudes towards gold and economic conditions, citing India as an example.

However, Fithra from Samuel Sekuritas Indonesia said that people are probably not queuing overnight to buy gold in developed countries, where it is often bought digitally, and stored in an account.

Gold is also available online in Indonesia but most people prefer to buy bullion gold because they perceive it as safer from digital fraud, since online attacks are not uncommon in the archipelago.

STAYING OVERNIGHT

Undeterred by her two failures, Resty went to the same ANTAM boutique for the third time on Apr 22, this time at 9pm.

When she arrived, there were already other hopeful buyers.

She discovered that a system had been put in place in the name of fairness: They all list their name down on a piece of paper in order of who arrives first, and treat it as an unofficial attendance list.

People wait in front of an ANTAM shop in South Jakarta at night to buy gold the following morning on Apr 24, 2025. (Photo: CNA/Ridhwan Siregar)

People wait in front of an ANTAM shop in South Jakarta at night to buy gold the following morning on Apr 24, 2025. (Photo: CNA/Ridhwan Siregar)

When the security officer arrived at 7am the next day he created an official list and handed out a number for them to queue, according to the quota set for that day.

That list is based on the unofficial attendance list, but the officer will first check to see if the person is still there.

Since some live far away or are afraid that their names will be skipped, they opt to spend the night at ANTAM, staying awake all night or sleeping in a sitting position.

When Resty arrived that evening, she was number 19 on the unofficial attendance list.

She decided to stay at the closed shop until past midnight, afraid that someone would delete her name, and then went home, returning at 4am.

When the security officer arrived in the morning and created an official attendance list, she was thrilled to find out she got number 17, as two people were not present.

Resty, who previously worked as a social media administrator, said gold is the easiest form of investment because it doesn't require much comprehension, unlike buying stocks.

“The current inflation is telling me that I need to invest. Nobody told me to do this (buy gold).

“(But) At the moment, there is a trade war between one country and another, which is likely to increase inflation and weaken the currency (rupiah),” said Resty, referring to the trade tensions between the US and China.

Resty Kinanthi showing the gold she just purchased at ANTAM's shop. (Photo: CNA/Ridhwan Siregar)

Resty Kinanthi showing the gold she just purchased at ANTAM's shop. (Photo: CNA/Ridhwan Siregar)

She had bought gold for the very first time eight months before, at about 1.4 million rupiah for one gram. On the day CNA interviewed her, ANTAM sold one gram of gold at 1.995 million rupiah.

Resty bought two bullion gold bars, each weighing five grams.

Online clothes seller Nina Ramdayani, 30, had already bought gold on Apr 22 but went again the next day because she wanted to have as much gold as possible.

She arrived at 10pm the night before and stayed at ANTAM all night.

She managed to buy three gold bullions of 25 grams each on her second day, whereas the day before, the only ones left for her to buy were three gold bullions of 10 grams.

“I am happy. My attempt to wait all night long has paid off,” she told CNA in a sleepy voice after just getting hold of the gold.

Nina returned to the same ANTAM boutique on Apr 24, for the third time and again bought three gold bullions of 10 grams.

Some rush to buy gold with the aim of reselling it, such as Achmad Faathir, who is based in Sukabumi, West Java.

Since his wage as a translator has been recently slashed, Achmad wanted to sell the three-gram gold bullion he bought in 2021 as the price is currently high and he needs the money.

Sukabumi has no ANTAM shop, and since Achmad happened to be in Jakarta for personal matters, the stars aligned for him to resell his gold.

Achmad arrived at 8am on Apr 23 and got number six.

“If I resell at a (jewellery) gold shop (in Sukabumi), the difference could be up to 100 thousand rupiah,” he said.

Achmad Fathir (left), a customer, waiting for his turn to sell gold at ANTAM's shop in South Jakarta on Apr 23, 2025. (Photo: CNA/Ridhwan Siregar)

Achmad Fathir (left), a customer, waiting for his turn to sell gold at ANTAM's shop in South Jakarta on Apr 23, 2025. (Photo: CNA/Ridhwan Siregar)

PROS AND CONS OF THE GOLD RUSH

The gold craze is likely to continue as long as the gold price rises and the global economic outlook remains uncertain, economists said.

“If the global economy remains uncertain, gold prices will remain high,” said economist Fithra.

Veronica Kaihatu, a psychology lecturer at Pembangunan Jaya University in South Tangerang, said gold will remain a favourite metal among Indonesians due to cultural perceptions but the gold craze will likely decrease when people feel more secure about the economy.

“So this depends on social, political and economic conditions.”

Social researcher Devie from the University of Indonesia said that the gold madness provides a form of financial security.

Should one decide to buy gold jewellery, especially if one is unable to purchase bullion, then it is also good since it can be worn.

However, she said people should know where to save the gold because it is not safe in Indonesian homes, which are prone to disasters such as flooding and theft.

“Do you have a safe deposit box at the bank? If yes, put it there, not at home,” she said.

Financial planner Mike Rini from financial consultant Mitra Rencana Edukasi said all investment forms have their risks, including gold.

She said gold could be a good investment tool if the price is not volatile.

“Even though in the long term gold price tends to go up, it could also be volatile, going up and down between days.

“So to me it is good when it is meant for the long term,” said Mike.

“It is not meant to generate passive regular income.”

She added that people should diversify their assets into five different types, such as stocks, bonds, mutual funds, savings accounts, deposits, and possibly even properties and businesses.

They should also conduct research before buying gold, rather than just buying it based on instinct.

.png?itok=erLSagvf)