BANDUNG, Indonesia: Indonesian manufacturers are urgently seeking new export markets, after the United States last month announced a 32 per cent tariff on its goods.

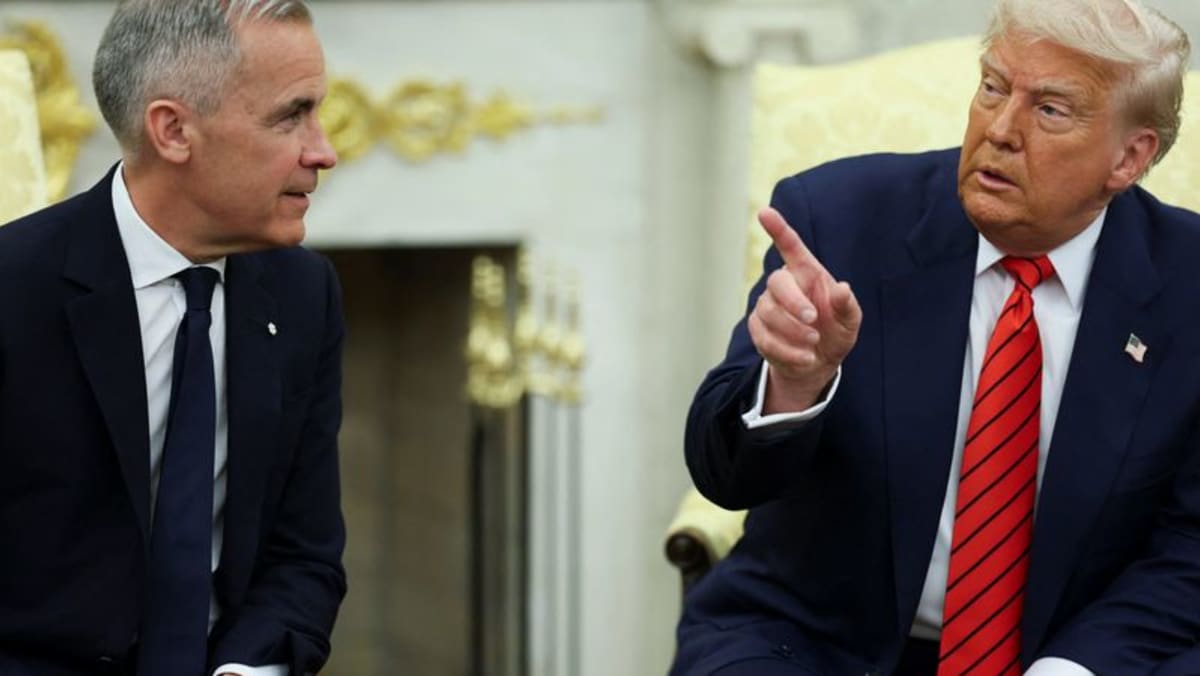

The country is currently negotiating US President Donald Trump’s punitive tariffs, which have been paused until July.

Having been reliant on the American market, many Indonesian manufacturers are now eyeing Europe and Southeast Asia, while others are looking for ways to tap their nation’s vast domestic market.

In April, Indonesia’s manufacturing sector shrank sharply with activity falling to its lowest since the COVID-19 pandemic - dragged down by weaker global demand, fallout from new US import tariffs, and softening domestic consumption.

FALLING DEMAND

PT Sipatex Putri Lestari, one of the country’s leading integrated textile manufacturers, is among many businesses in the industry that have been hit hard by falling demand due to the influx of cheap imports.

The firm, based in Bandung in Indonesia’s West Java province, recently laid off 300 staff and is set to cut another 100.

“Now we have to look for, think about or innovate something that is not found in imported goods,” said its director of operations David Leonardi.

“Something more special is needed. The point is innovation. What is it that these goods do not bring into Indonesia? That's what we need to find.”

Despite the challenges, Sipatex said it is staying focused on the domestic market and adapting to changing consumer needs.

It also has plans to replace more than 500 ageing machines by 2030 to boost efficiency.

SEEKING NEW MARKETS

Indonesian textile manufacturers rely heavily on the US market, with exports valued at US$4.6 billion last year.

But the Indonesian Textile Association warned that demand could drop by as much as 30 per cent after the US announced steep tariffs to address trade imbalances.

The industry is now urgently seeking out new markets.

“Southeast Asia and its surrounding regions are areas with very high market potential,” said Danang Girindrawardana, the association’s executive director.

“We haven’t tapped into them optimally because Indonesia has become accustomed to or become spoilt by existing markets. We have become complacent and not engaged with neighbouring countries, which could be involved in the import-export process of textile and garment products.”

Indonesia is drafting a White Paper to help regional manufacturers work together amid the global economic uncertainties.

The country leads the ASEAN (Association of Southeast Asian Nations) Federation of Textile Industries, which represents the interests of Southeast Asia's textile and apparel manufacturers.

Trump’s tariffs have also revived calls for Southeast Asia to strengthen internal trade to mitigate geopolitical shocks.

While almost all intra-bloc tariffs have been lifted, non-tariff barriers are on the rise and pose fresh challenges for regional integration, said observers.

“Some non-tariff measures can also be barriers, particularly when it comes to procedures (and) obtaining the licensing,” said International Economic Association secretary-general Lili Yan Ing.

“That's something that ASEAN can work together on how to simplify procedures, licensing and how to obtain certain certificates to improve intra-ASEAN trade.”

In April, Indonesia’s Coordinating Minister of Economic Affairs Airlangga Hartarto led a delegation to Washington to push for more favourable trade terms.

Jakarta is also accelerating multilateral cooperation such as the Indonesia-European Union Comprehensive Economic Partnership Agreement to facilitate new market access and increase trade.

Launched in 2016, negotiations for the free trade agreement are expected to conclude this year.

While the government works to open up new markets, manufacturers are urging stronger protection for labour-intensive industries which have long faced an influx of low-cost imports from China.

While tensions in the US-China trade war may have eased slightly, businesses told CNA that the situation remains unpredictable.

There are growing concerns that Chinese producers could redirect excess supply into Indonesia, flooding the local market and putting even more pressure on domestic manufacturers.

"We are now living in a time where nothing is certain. But I’m confident that demand will rise once more, and this also presents an opportunity for industries that can provide the products needed," said Leonardi.

"I'm also optimistic because conditions like this won’t last forever."

.png?itok=erLSagvf)