SINGAPORE: To create luxury ambient scents for his perfume products, Singaporean entrepreneur and perfumer Jason Lee sources ingredients and materials from different countries.

Orchids are sourced from Thailand, along with delicate longjing and da hong pao teas from China. He gets heady ylang ylang flowers from Malaysia, earthy patchouli from Indonesia and exotic agarwood through Laos and Cambodia.

High-quality packaging like glass bottles and atomisers - imported from China - completes the product, with the nozzles designed to blend air and liquid into a fine mist.

This painstaking process for his brand Scent by SIX has shown Lee just how “interdependent” markets across the region truly are.

“It isn’t just about cost. It’s (also) about access to each country’s specialities and capabilities,” Lee told CNA.

“And it made me realise that China and Southeast Asian countries aren’t just markets or locations, but truly vital partners for creation.”

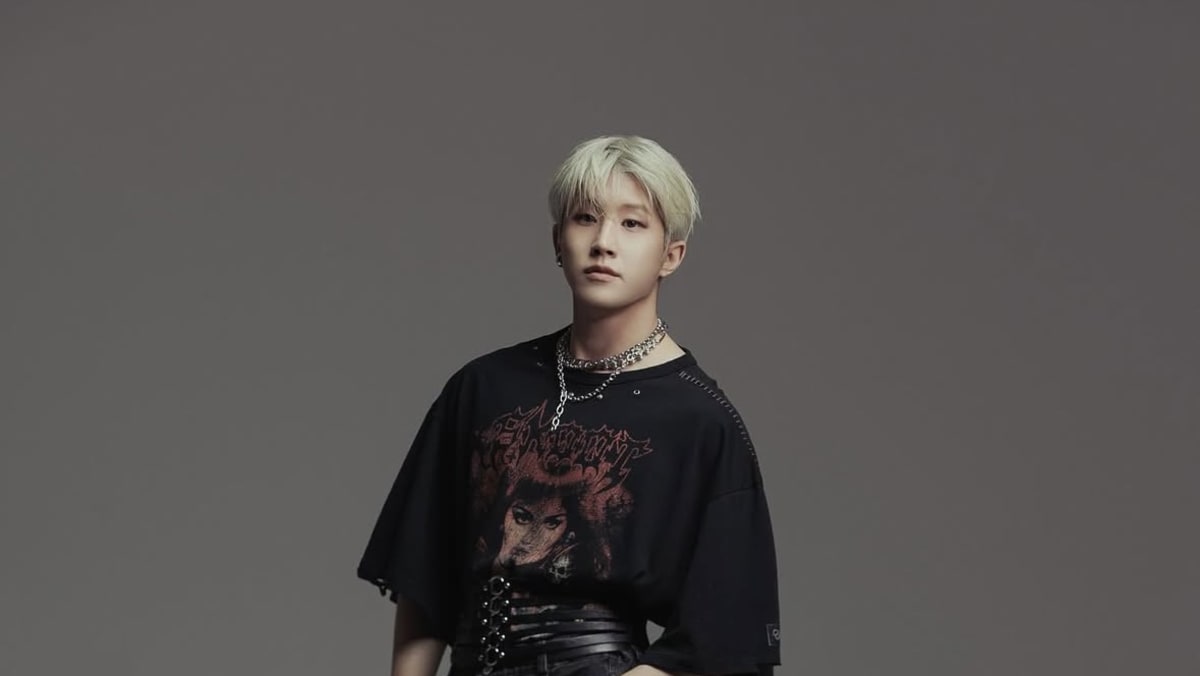

Jason Lee, founder of Singapore-based fragrance label Scent by SIX, says sourcing ingredients and materials from across ASEAN and China has shown him how interdependent regional markets truly are. (Photo: Scent by SIX)

Jason Lee, founder of Singapore-based fragrance label Scent by SIX, says sourcing ingredients and materials from across ASEAN and China has shown him how interdependent regional markets truly are. (Photo: Scent by SIX)

That is why he views the upcoming upgrade to the ASEAN-China Free Trade Area (ACFTA) 3.0 - slated for signing in October 2025 - as a "game changer" for businesses like his in deciding whether to enter the Chinese market, citing how the new pact will focus on the digital and green economies, as well as supply chain cooperation.

He added: "I think it will remove a lot of inaccessibility for small and medium enterprises in terms of the capabilities, knowledge and predictability as well."

Speaking at a conference in China's Huangshan city earlier this monthh, ASEAN Secretary-General Kao Kim Hourn also lauded the upgrades in modernising the FTA and helping it "open new doors in the digital economy, green economy and supply chain connectivity".

"It will redefine ASEAN-China economic relations through innovation and competitiveness,” he added.

Analysts also said the agreement lands at a timely but delicate moment, as Southeast Asia grapples with both a retreat by the US from global trade and the ripple effects of China’s export glut.

Who stands to gain most from the upgraded deal? Much will depend on the fine print - and businesses across the region are watching closely to see whether it can live up to expectations after two years and nine rounds of negotiations.

ACFTA 3.0: WHAT’S NEW - AND WHY NOW?

First signed in 2002, ACFTA was China’s first free trade agreement and ASEAN’s first with a major external partner. For Singapore alone, the deal eliminated tariffs on nearly 95 per cent of exports to China, while expanding market access.

The latest provisions under ACFTA 3.0 will cover new and enhanced regulations in areas like supply chain connectivity, competition and consumer protection.

“This is a much-needed upgrade,” said Priyanka Kishore, founder and principal economist at Asia Decoded, a macro-consultancy providing advisory services to policymakers.

“(Policymakers) have taken into account pandemic disruptions, which I think is very important and there's a focus on strengthening supply chain resilience in critical and essential goods,” Kishore added.

“These agreements are not just about lowering tariffs - they are about building long-term resilience, enhancing economic integration and enabling our businesses to thrive in a rapidly evolving global environment,” Kao said.

Analysts also pointed to stronger commitments in emerging areas like the digital and green economies as ASEAN nations work towards sustainability goals.

“Areas like solar panels and batteries,” said senior analyst Lee Chi Him from the Economist Intelligence Unit (EIU).

“Indonesia's solar projects tend to have (a lot of) local requirements so for Chinese exporters, there will be limits in terms of what they can do in that market,” he said, adding that it will be interesting to see whether such non-tariff barriers are addressed.

Lucas Myers, a research affiliate at George Washington University’s Sigur Center for Asian Studies, noted that the new ACFTA provisions will carry both economic and geopolitical implications for China and its trade partners across Southeast Asia, especially as the US distances itself from regional trade frameworks.

“With an absent US uninterested in free trade, China believes it can position itself as the defender of regional multilateralism and the existing trading system,” Myers told CNA, adding that ACFTA 3.0 will deepen China-ASEAN relations, “handing Beijing more leverage”.

“In doing so, China can weaken US’ influence (in Southeast Asia) and ensure that it usurps the role traditionally played by Washington.”

Others agreed that the pact sends a strong geopolitical message - but have also urged caution.

“It’s coming at a tricky but opportune time (for overseas markets) looking to de-risk slowly from the US,” said Kishore.

She noted that the upgraded pact “comes at the right time” to strengthen the region’s integrated push - but added that Southeast Asia will also need to tread carefully in managing concerns over Chinese industrial overcapacity spilling into the region.

“(ASEAN member states) are aware that there is a challenge to the local industries from Chinese goods that are coming in,” said Kishore.

A container ship arrives in a port in Singapore, a key regional hub in ASEAN-China trade. The upgraded ACFTA 3.0 pact is expected to deepen integration and streamline supply chains across the region. (File photo: Reuters/Darren Whiteside)

A container ship arrives in a port in Singapore, a key regional hub in ASEAN-China trade. The upgraded ACFTA 3.0 pact is expected to deepen integration and streamline supply chains across the region. (File photo: Reuters/Darren Whiteside)

UNEVEN GAINS: WHO BENEFITS MORE?

If ACFTA 3.0 is a bridge to the “economy of the future”, as several analysts described it, then not all ASEAN countries are starting from the same bank.

Some, like Vietnam and Thailand, are poised to gain early. “Vietnam and Thailand are increasingly destinations for Chinese companies to invest in manufacturing, and this deal’s supply chain provisions will only boost their attractiveness for Chinese investors looking to offshore,” said Myers.

There will be “a real opportunity for Singapore and Malaysia” to deepen their roles as hubs in the regional digital economy, Myers added.

Singapore, Kishore noted, has been “one of the fastest growing areas (in the region) in terms of its digital economy”.

“It has one of the fastest-growing exports of digitally deliverable services in the world and China is one of its key partners, a lot of FinTech exports happen between Singapore and China so it’s definitely an important area.”

EIU’s Lee said Singapore, Malaysia and Thailand have “been benefiting a lot from trade with China already”.

“In this context, they will benefit from the economic integration in terms of ease, trade, as well as better protection for investments and investors”.

Kishore also warned of a long-term risk for Thailand.

The kingdom’s manufacturing prowess - spanning steel mills, cable factories and EV component plants - has made it a focal point for Chinese green-economy investments, even as the nation imposes anti-dumping duties on steel to protect local producers.

“The risk, which is actually playing out in Thailand (now), is Chinese investments come in … help develop the green economy, but knowledge transfers do not happen,” she said.

“So it ends up being dominated by Chinese manufacturers in these New Age industries but you don’t build domestic capabilities.”

Myers signalled the risks to ASEAN’s companies and industries “if Chinese firms come to dominate and crowd out smaller Southeast Asian businesses”.

“There are also worrying signs that the deal's primary beneficiaries will be large Chinese firms that are already dominant in 3.0’s target sectors, like electric vehicles (BYD) and digital infrastructure (Huawei),” said Myers.

Smaller and less-developed economies like Cambodia, Laos and Myanmar would not stand to gain as much, Lee, the senior analyst from EIU said.

“They are at very early stages in terms of development and do not necessarily have very sophisticated exports that can go to China.”

But on the other hand, technology transfer, technical cooperation and assistance could prove very beneficial for those countries, Lee added.

“We also know that the Philippines does not have the best relations with China, and in terms of the economy, (its goods and products) do not necessarily gravitate towards areas Chinese consumers are particularly interested in.”

“As it currently stands, the Philippines may not benefit a lot from ACFTA 3.0.”

Since the ACFTA’s implementation in 2010, data shows that trade between China and ASEAN has more than tripled, to US$696.7 billion in 2023 from US$235.5 billion.

In the first four months of 2025, bilateral trade totalled 2.38 trillion yuan (approximately US$330.86 billion), reflecting a 9.2 per cent increase compared to the same period last year, according to data from China’s General Administration of Customs.

However, while China’s share of ASEAN trade jumped from 12 per cent in 2010 to around 20 per cent by 2023, ASEAN’s imports from China have surged far faster than its exports there, widening the bloc’s trade deficit to over US$190 billion.

“China’s market and capital are so disproportionately powerful that individual countries and their firms find it difficult to compete in a bilateral setting,” Myers said.

“And there are concerns that ACFTA 3.0 will enable China to deepen this imbalance in its favour over time.”

ON THE GROUND: HOW SMES STAND TO GAIN

Micro, small and medium enterprises (MSMEs) make up the backbone of ASEAN’s economy, but challenges on the ground still remain, especially for smaller firms and start-ups struggling to navigate complex regulatory environments.

“Simplified streamlined processes and stronger grassroots implementation” will be critical going forward, ASEAN Secretary-General Kao said.

“Breaking that initial barrier of awareness and simplifying the process is really key,” said Lee, the Singaporean entrepreneur who also serves on an official MSME committee at the Singapore Business Federation.

“Practical, industry-specific support from government or trade bodies is something that is very crucial,” Lee added.

“And if paperwork seems too daunting, you wouldn't want to incur any associated costs (and) you’ll just miss out on the advantages.”

Scent by SIX's luxury perfumes and diffusers often feature ingredients like Thai orchids, Malaysian ylang ylang, and Indonesian patchouli - highlighting the brand’s reliance on regional supply chains. (Photo: Scent by SIX)

Scent by SIX's luxury perfumes and diffusers often feature ingredients like Thai orchids, Malaysian ylang ylang, and Indonesian patchouli - highlighting the brand’s reliance on regional supply chains. (Photo: Scent by SIX)

Yang Juejun knows the challenges of navigating complex regulations all too well.

The company she works at, Suzhou Mega Plastics, which exports specialised medical and industrial cable polymers to countries like Thailand, Vietnam and Indonesia, has had to deal with regulatory hurdles across the region.

Southeast Asia is one of the company’s largest overseas markets by export volume, accounting for 40 to 50 per cent of its total export trade.

“One of the primary difficulties we face is product certification,” Yang, the company’s board secretary, told CNA.

“Markets like Thailand and Vietnam enforce their own certification systems and we must undergo a separate domestic certification process, which adds both cost and time,” she said.

Logistics and warehousing pose additional challenges.

“Establishing local warehousing facilities would involve substantial investment and operational complexity on our part,” Yang said.

“For these reasons, we are hopeful that the ACFTA 3.0 provisions will include policy support for companies with growing trade volumes in Southeast Asia.”

“We are expecting major green-energy investment projects in Southeast Asia to help sustain our downstream volumes and drive greater demand across the region,” she said.

If ACFTA 3.0 aims to redefine the region’s trade future, analysts believe what counts as success will vary - and so will the time needed to see it.

Kishore of Asia Decoded emphasised that integration in new sectors must be matched by real outcomes. “I would definitely look at how the digital economy integration has progressed between the two regions,” she said.

Services trade offers one of the clearest benchmarks. “We (ASEAN) do run a surplus with China on services,” she said, noting that opportunities may grow as ACFTA 3.0 streamlines digital rules.

“That's where the advantages could emerge - that we get more digital access to Chinese markets, but it's tricky for sure.”

“ACFTA 3.0 feels quite different,” said Lee, who feels that change could be “truly transformative, really empowering businesses on the ground”.

The real test of ACFTA 3.0 will be whether it enables more small businesses to act regionally from day one.

“Success would be measured by the number of MSMEs actively trading regionally, not just the total trade value dominated by large corporations,” he said.

“It’s really seeing young entrepreneurs confidently looking at the entire region as the whole market from day one - because (they know) the systems truly support them.”