SINGAPORE: Malaysia recorded 5.1 per cent growth in 2024, surpassing expectations thanks to its recovering tourism and exports sectors, rebound in construction and real estate activity and strong labour market. These have been supported by the government’s fiscal policies and stable interest rates.

However, entering 2025, there is uncertainty about the implications of a second Trump term in the United States. US President Donald Trump’s proposed tariffs could trigger permanent change around trade ties and supply chains. There are also rising risks that retaliation from targeted countries could escalate into a trade war that benefits nobody.

Malaysia will chair the Association of Southeast Asian Nations (ASEAN) during this fragile period. Escalating tensions, including potential conflict in the South China Sea could force a shift in geopolitical alignment that challenges the neutrality of ASEAN.

MALAYSIA HAS COME A LONG WAY

Malaysia has come a long way since the Asian Financial Crisis with stronger institutions, more diverse inflows of foreign direct investment, orderly functioning of domestic markets and focused plans for structural reforms.

One area that has shown tremendous progress is Malaysia’s semiconductor industry. The country is creating global integrated circuit champions and attracting leading international companies to establish wafer fabrication facilities and data centres.

The next step is to focus on digital investments and employ more sustainable production methods to reduce carbon emissions. In this vein, Malaysian automaker Proton launched its first electric vehicle in December 2024, four decades after introducing its first national car in 1985.

Regional development has been a key priority with incentives offered for investments across 21 sectors in selected states, including Perlis, Kedah, Kelantan, Terengganu, Sabah and Sarawak.

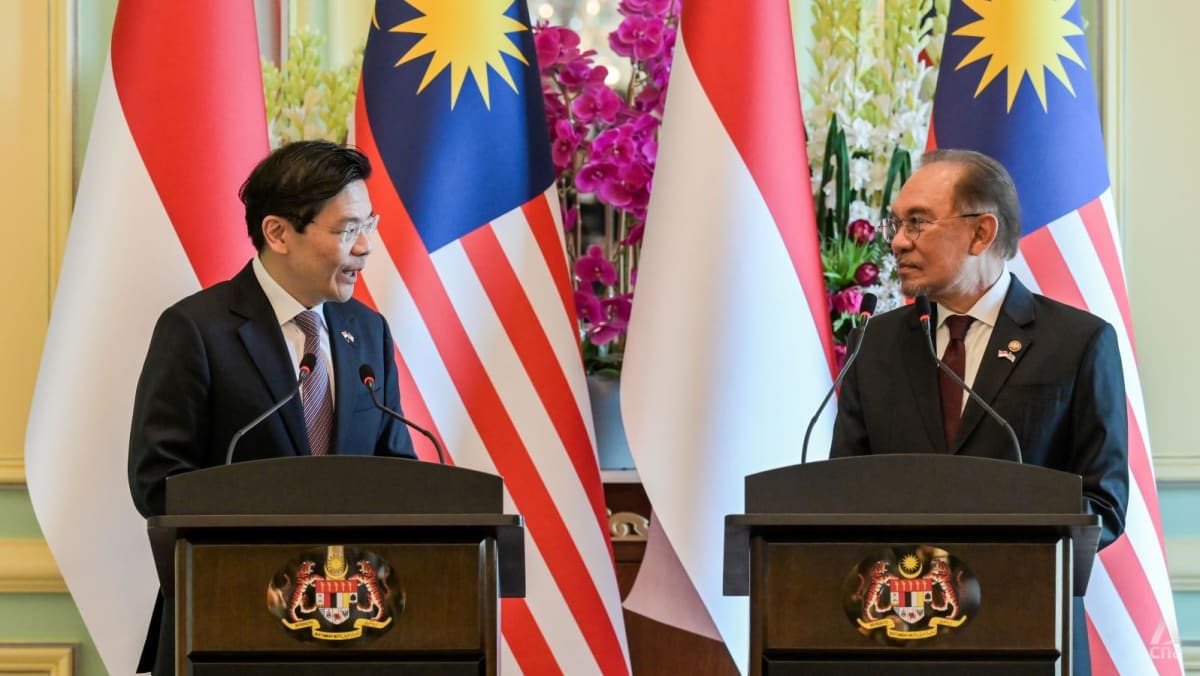

A major milestone will be the Johor-Singapore Special Economic Zone, which aims to create 20,000 skilled jobs. The Forest City Special Financial Zone, launched in September 2024, will further stimulate growth and investment in Johor.

RISK OF CURRENCY VOLATILITY

For Malaysia, the path forward is clear - to diversify its economy and accelerate critical reforms.

However, the currency markets could throw a spanner in the works. The US dollar has strengthened since Trump won the 2024 presidential election. Markets expect more tariffs and more hawkish signals for US interest rates.

As a result, Malaysia has to brace for further currency volatility and potential ringgit weakness alongside other Asian currencies. The central bank has to maintain exchange rate flexibility and ensure the ringgit’s value is not misaligned from economic fundamentals.

The good news, compared with 2017 when Trump started his first term, is that Malaysia now has stronger macro fundamentals that provide underlying support for its currency.

The ringgit will be able to tide through the next phase of volatility with greater resilience due to efforts to encourage more consistent inflows by government-linked companies and Malaysian corporates, as they repatriate their overseas profits back home.

Liberalised foreign exchange policies for non-resident development financial institutions and multilateral development banks will also help. This is because they are now able to structure financing in ringgit to help mitigate foreign exchange risks and smoothen the volatility in the ringgit.

STRENGTHENING TRADE TIES

Trump’s second term could lead to tariffs on Malaysian goods or that of Malaysia’s key trading partners. The best way to mitigate tariff risk is by ensuring exports are “truly Malaysian”. For goods with cross-border supply chains, it is important that a significant part of the production is done within Malaysia so that the US cannot accuse companies of using Malaysia as a conduit to escape tariffs.

Another way is for Malaysia to import more goods from the US to balance the trade surplus, and to position itself as an enabler of US productivity growth rather than a competitor. This can be done by enhancing the value of products using US imports and technology. This helps Malaysia ascend the value chain and accelerate US innovation.

Malaysia continues to explore trade agreements and multilateral cooperation to diversify its markets and import sources. A free trade agreement between Malaysia and South Korea is expected to be finalised in 2025, while the negotiation of a free-trade agreement with the European Union is still ongoing.

Malaysia also officially became a new partner country of BRICS along with Indonesia (which is now a full member) and Thailand. Taken together, these will enhance the country’s trade resilience.

As ASEAN chair of 2025, Malaysia will undertake high-level trade negotiations on behalf of the regional bloc.

Negotiations to enhance the free trade agreement between ASEAN and China are expected to conclude in 2025, and will cover upgrades in the digital and green economies.

Though this will strengthen China’s importance as an economic partner to ASEAN, the US is still the region’s largest investor. It is thus equally important to maintain warm ties with the world’s largest economy.

Meanwhile further engagements are planned with ASEAN+ partners including Japan, South Korea, India, Australia and New Zealand.

Amid heightened trade frictions and geopolitical tensions, Malaysia needs to attract diverse investments and strengthen trade links with a wider range of partners. Its chairmanship of ASEAN is also an opportunity to showcase the benefits of regional integration.

Julia Goh is Senior Economist (Malaysia) at UOB.

.png?itok=erLSagvf)