Ms Daphne Ling (centre) on a 2023 family holiday to Kyoto, Japan with her five children, Truett (17), Kirsten (16), Finn (13), Theo (11) and Hayley (9). (Photo: Daphne Ling)

New: You can now listen to articles.

This audio is generated by an AI tool.

SINGAPORE: In his Budget speech, Prime Minister Lawrence Wong announced fresh support measures for families with three or more children in the new Large Families Scheme.

This scheme will provide Singaporean parents with up to S$16,000 for each third and subsequent child born from Feb 18. Families that already have three or more children aged six or below - born between Jan 1, 2019 and Feb 17 this year - will also receive S$1,000 each year for each eligible child until they turn six.

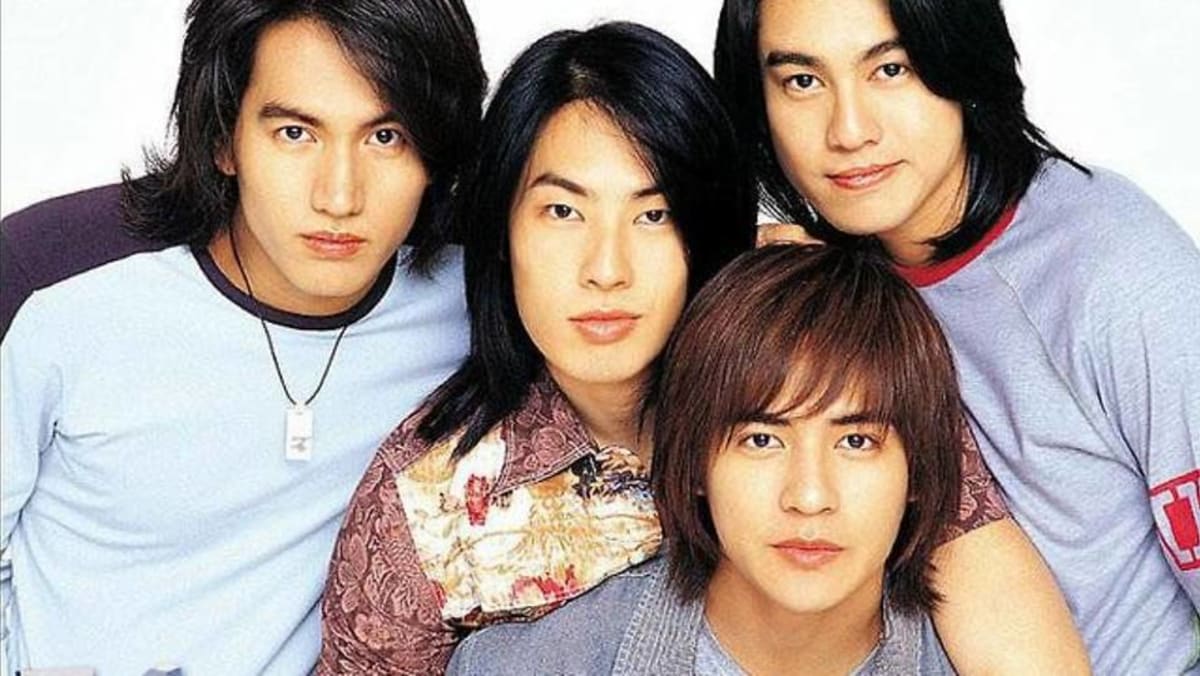

As a mother to five children (aged between eight and 17), my first thought was “I wish this announcement had come 12 years ago when we were having baby number three”. It was followed briefly by a second thought: “Is it too late to consider having babies six and seven?”

There was a time when I wanted to have seven children, an idea my husband has always been on board with - but we already have five grown children and it would be too challenging to start over with a newborn in our 40s. Rational thought tells me that it’s clear my baby-making years are well behind me.

However, because I know how financially draining having many babies can be, it’s very heartening to see the government taking steps to support large families.

HOW WE AFFORD TO HAVE 5 KIDS

The question I often get asked by couples who would like to have a large family is: “How could you afford to have five children in a country where the cost of raising kids is so high?”

The truth is that for many years, we barely could.

Like many young Singaporean couples, my husband and I were middle-class and had nothing in our bank accounts when we started working entry-level jobs after graduating from university. After our first child was born, we decided that I should quit my job to become a stay-at-home mum, effectively halving our household income.

This was 2008, when flexible work arrangements for mothers were rare. So, to supplement our family’s income, I took on every part-time writing assignment, data entry project and tuition opportunity I could find.

We were prepared to make sacrifices in pursuit of our shared dream of having a large family, but during our kids’ early years, we often saw our bank account dwindle down to double digits. We became experts at finding the best deals to stretch every dollar we had.

WILL THE ADDITIONAL MONEY MAKE A DIFFERENCE?

I don’t know if these new measures will be effective in raising Singapore’s historically low birth rate.

But what I do know for sure is that this boost of support will go a long way for couples who are already considering enlarging their family but are concerned about being able to afford it.

Take for example the Child Development Account (CDA) First Step Grant that can be used for medical and childcare fees. Under the new scheme, this amount will be doubled to S$10,000 for couples’ third or subsequent child.

When our first child was three months old, he contracted a severe case of bronchiolitis and we had to bring him into the hospital three times that month. Each consult was S$162.80, not including additional hospital fees; by the third visit to KK Women’s and Children’s Hospital, we had wiped out our emergency funds.

It was difficult enough being exhausted new parents; worrying about our sick baby and how to afford groceries until my husband’s next payday made things infinitely worse.

On another occasion, we had to delay one of the kids’ scheduled vaccinations because we could not afford the S$150 it cost. I remember sitting in the clinic being lectured by the well-meaning doctor on the importance of timeliness for our baby’s vaccinations, feeling helpless and defeated.

With each additional child, doctor’s visits became even more frequent and all the medical fees added up to a considerable amount. Over the years, the CDA grants for our third to fifth children came in very handy in covering these costs.

The writer's oldest three children in a 2014 photo, aged six, five and two respectively. (Photo: Daphne Ling)

The writer's oldest three children in a 2014 photo, aged six, five and two respectively. (Photo: Daphne Ling)

Apart from medical costs, the biggest other financial burden is childcare.

During the years we were juggling three children under the age of six, we often felt like we were drowning in monthly childcare fees.

In the latest Budget measures, childcare fees will now be capped at S$610 for anchor operator centres and S$650 for partner operator centres. I did a calculation of the amount an average family with five children would spend on childcare and it came up to about $72,000 (four years of childcare each at S$300 per child per month after subsidies).

For new parents just starting their journey of having babies, with the new Large Families Scheme, they will be receiving government support of S$160,000 in total if they have five children, which will help to cover the costs of childcare for all the children.

On top of the Baby Bonus and CDA top-ups, parents will also receive S$1,000 each year in LifeSG credits for each third and subsequent child from the ages of one to six, or a total of S$6,000 over six years.

Having had five babies with significantly less financial support, I am certain that couples with many young children or are planning to have them will welcome this new scheme with open arms and immense gratitude.

WHAT ABOUT LARGE FAMILIES WITH OLDER KIDS?

With all our children now above the age of six, we will not be benefitting from most of the new measures. Can more be done for families like ours?

Like most Singaporeans, we look forward to the Budget speech every year, hoping for measures that will benefit us. But after giving it some thought, it is absolutely the right move to allocate the budget to families with younger children because this is the time where they need it the most.

As our children get older, the financial strain eases because costs like school fees drop from S$300 to S$13 a month once they start primary school.

My kids now spend most of their days in school, so I’ve been able to go back to work. My eldest, who turns 17 this year, just started his first part-time job and is well on his way to becoming a contributor to the household income.

Still, it’s a welcome bonus for our two youngest kids to receive the S$500 in LifeSG credits which can be used for groceries, utilities, pharmacy items and transport services.

IS THIS ENOUGH?

There’s a tendency for Singaporeans to question whether any amount doled out by the government is enough to incentivise couples to have babies - but perhaps this is a misguided tack.

For a start, couples who are not planning to have babies will not do it simply for the money. There are also other vital concerns such as housing costs, and helping working parents - especially mothers - to be able to balance career-building and child-rearing, with flexible work arrangements, for instance.

Instead, the question should be whether this helps the couples who do want to have a large family but are worried about whether they can afford it.

For young parents who need all the help they can get with making ends meet, this aid can give them some much-needed room to breathe. For many, it may even make it possible to go for that one more child they’ve been dreaming about having.

Beyond just receiving money, the spotlight the Large Families Scheme was given in this year’s national Budget brings me a lot of comfort in knowing that our nation’s leaders are well aware of the particular difficulties large families face and are doing what they can to provide support.

Perhaps if this had been announced nine years ago when we just had our fifth baby, we might have gone for one or even two more. But now, I can only hope that my own kids will eventually make my dreams of having many grandchildren come true - and that, if they do, they’ll be given the support they need to make it work when the time comes.

(But no pressure, kids!)

Daphne Ling is a mum of five. She is also the co-owner of an advertising agency and a cafe.